Are Daily ‘Dividends’ Possible with 0DTE Options?

I love the concept of probability. Likelihoods, percentages, ratios. They influence my thoughts and behaviors in so many facets of life. He’s a 70% free throw shooter, what are the odds he makes ’em both? Are they going to bunt this time or hit into another double play? Will WalMart have everything, or am I gonna have to hit Lowe’s? Will this flight cost more or less in a month? It’s snowed 16 days in a row; has that ever happened before? Do we have time to eat dinner out before the game? Meta just went up 20 straight days – can that continue?

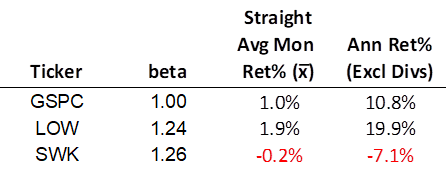

A bit closer to home is option trading. A healthy understanding of probability and its relationship with risk is critical to success with options, but certainly no guarantee.

If you read on, there’s a 98% chance you’ll acquire a better understanding of probability and the inherent risk in a simple ODTE option strategy which addresses the question you’re all undoubtedly asking, “Can 0DTE options be used to generate a safe and reliable source of income?”

Well, that is what we’ll try and find out.1

…Are Daily ‘Dividends’ Possible with 0DTE Options?Read More »