Remarkably, three Dividend Kings have chosen to cut their dividends this month. And these weren’t just any Kings, but Kings in the Portfolio for the Ages. LEG cut their quarterly dividend 89%, from $0.46 to $0.05. MMM cut their dividend 54% from $1.51 to $0.70. Then on Tuesday, the newly crowned – and to my knowledge, the first ever Dividend King from the Communication Services sector – announced a major sale of assets they own and control, to T-Mobile [TMUS]. This was news we’ve been waiting for since August 2023.

Unfortunately, this highly anticipated press release also announced a 79% reduction to its dividend. Folks, Telephone and Data Systems, Inc. has abdicated the throne!

TDS was the last company added to the Royal Dividends portfolio when it was first built out with a stock from each of the eleven sectors. It was the only one of those first eleven positions that did not yet have a 50+ year dividend increase streak. I believed TDS was significantly undervalued, but it was struggling to grow earnings. The very fact that the position has always been covered by calls is an acknowledgement that the dividend wasn’t safe.

At the time the position was added to the portfolio, earnings per share [EPS] in four of its previous seven quarters failed to cover the dividend, but all seven of those quarters had seen positive EPS. Then, as a constituent of the portfolio and armed with the knowledge that TDS had a plan to turn their performance around, the situation got uglier before it was to get better. EPS over the next six quarters were negative. But (!) EPS for 2024Q1 was $0.10 – a sign that a turning point may have been reached.

Did TDS Need to Reduce its Dividend?

Over the last two years, TDS has paid out $1.47 in dividends per share. Over that same time, the EPS has been $(5.40). Of course, this is unsustainable. The deal struck with TMUS is expected to be finalized in mid-2025. Could TDS continue to pay the higher dividend until then? Probably.

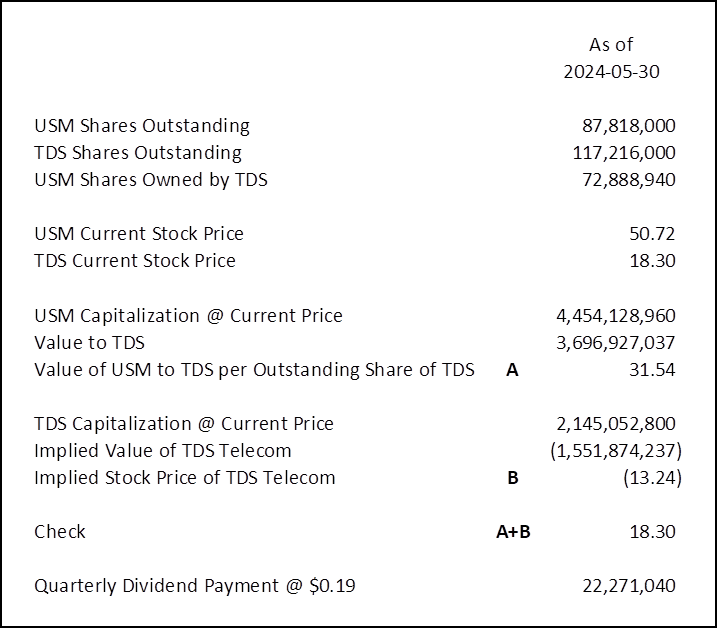

However, USM will be a smaller company going forward as all of its wireless business and 30% of its spectrum business is to be sold off for a substantial amount of money. The $4.4 billion purchase price will be a combination of cash and assumed debt and when those amounts are determined and paid to USM, the proceeds will flow to TDS in kind on a prorated basis. With an 83% ownership stake, that will be a significant amount of cash and balance sheet improvement. Now, because USM is about 80% of TDS revenue today, a smaller USM means a smaller TDS after the sale. Below, is an attempt to gauge the value of USM to TDS today.

A few things to note: TDS is essentially the combination of two businesses, TDS Telecom and the publicly traded UScellular [USM]. The latter now carries a market capitalization essentially equal to the $4.4 billion price discussed in the press release. The value of USM to TDS is $31.54 per share of TDS. This should anger shareholders of TDS because it suggests that TDS is grossly undervalued trading at $18.30. How can this be? It means the market implicitly assigns negative worth to the smaller fiber optics business, that somehow TDS Telecom is economically destructive. Is that true? No. Both components of TDS contributed positively to the small, but positive 2024Q1 EPS of $0.10.

The fact of the matter is that the efficient-market hypothesis is great on paper but falls apart in reality; the market does not always ‘get it right’ at a snapshot in time. However, the market is adjusting at each phase of this process. TDS has been a way to get shares of USM on the cheap and once it was announced that TDS was willing to sell USM back in 2023, the share prices of both companies jumped. This suggests that the market felt and still feels that USM was worth more to someone else than to TDS.

The news of the acquisition seems to have benefited all three parties; the share prices of TMUS, TDS, and USM are all somewhat higher post-announcement. This makes sense as explained in the TDS press release:

Continuing to deliver for UScellular’s customers requires a level of scale and investment that is best achieved by integrating its wireless operations with those of T-Mobile.

Walter C. D. Carlson, Chair of the TDS Board

The board is in agreement with what the market has been implying. Personally, I think Mario Gabelli, through GAMCO Asset Management’s large 4.3% stake in TDS was at least partially responsible for the announcement of this new deal1. Now, it didn’t have to be T-Mobile, it could have been another large player. But the point is that the assets of USM were best ‘unlocked’ or monetized by a national player of scale.

This is all to say that TDS has sold a massive portion of its business and when the deal closes any cash proceeds could be paid back to TDS shareholders, but only as a return of capital, not as dividends paid out of earnings being generated as a going concern. And return of capital is just one of the uses that TDS has in mind, stating that:

…TDS will utilize such proceeds in the best interests of its shareholders. Depending on the amount of proceeds, those uses are expected to include continuing to invest in the company’s fiber build-out program and reducing leverage levels, and may include return of capital to shareholders and the pursuit of other opportunities to grow the business.

2024-05-28 TDS Press Release

So, the answer: I believe the dividend reduction was unavoidable and it is no surprise that the new dividend of $0.04, a near 80% reduction, is commensurate with the size of the business being sold off.

What’s Next?

Investors steeped in resiliency and possessing an indomitable spirit, like me, naturally look to the future and want to know what happens next. Within the Royal Dividends portfolio, it would be difficult to argue against the fact that TDS, as a business, has performed the worst. However, as a stock, TDS has been the best performer both in absolute unrealized gains and annualized return.

But their dividend cut resets their dividend streak from 50 to zero. Removal from the portfolio is an absolute certainty because TDS no longer qualifies for inclusion in the Empire.

I will avoid closing out any position at a loss like the plague. Further, I didn’t start this portfolio to settle for small gains; I am after sick, inexplicably high returns. TDS may just be the very definition of ‘sick, inexplicably high returns’.

I am watching TDS very closely right now. Many retail investors were hoping that TDS would be acquired in its entirety. Others were hoping that the sale of US Cellular [USM], of which TDS owns 83%, would be cleaner, more straightforward. Still others think another announcement, perhaps involving Verizon [VZ] and some or all of the remaining spectrum-related assets of USM, is forthcoming. And certainly, there were shareholders that have invested in TDS for their dividend and have dumped the stock. Suffice it to say, the price action is a bit erratic and should settle soon.

I expect to close out the call position and sell all the TDS shares soon enough, but not until I gain some comfort with where TDS is trading. This can be done in two transactions or together. There is also the option (yes, pun intended) to sell the uncovered shares first, then roll the covered calls ‘down and in’.

Nevertheless, when the position is eventually closed, I expect there to be significant gains and the proceeds will go into the highest ranked stock in the Communication Services sector within the Empire at the time2. The table below welcomes new Royal Heir, BCE Inc. (BCE being an abbreviation of Bell Canada Enterprises), into the Empire as a result of TDS’s departure.

| Name | Ticker | Years |

| John Wiley & Sons Inc | WLY | 30 |

| Telus Corp | TU | 20 |

| Verizon Communications Inc | VZ | 17 |

| Comcast Corp | CMCSA | 16 |

| BCE Inc | BCE | 16 |

Please note that when I speak of ‘highest ranked’ I am speaking with regard to expected total returns [ETR] and not the dividend increase streak above. Also, because none of the companies above are Kings, none of them receive preferential treatment in the safety ranking that I employ after ranking stocks by their ETR.

As it turns out, VZ and CMCSA both made the Top Ten last week. Either would be a suitable replacement.

- I discuss shareholder activism and Mario Gabelli’s letter to LeRoy T. Carlson, Jr., President and Chief Executive Officer of TDS in my 2023-06-02 post. ↩︎

- Closing the position in TDS creates an immediate sector imbalance that can only be corrected by rolling the proceeds into another company in Communication Services, as it would be the only sector eligible for investment. Of course, the option to spread the proceeds among multiple investments exists, but there is increased value in putting the entire amount into one’s best idea at the time, so long as a healthy diversification is maintained. ↩︎