Two days ago, I was preoccupied with Leggett & Platt’s decision to reduce its dividend 89%, from $0.46 per quarter to a nominal $0.05 per quarter, thereby ending its 52-year streak of annual increases and its reign as a Dividend King. I was distraught and angry. Perhaps more than usual. Then circa 1:00am last night, perusing my own personal echo chamber of news headlines, I learned that ANOTHER Dividend King had announced plans to cut and run. The 2024Q2 dividend won’t be declared until May. It will be subject to board approval, but I’m calling it now.1

Put a Post-it note on the fridge for all to see: 3M Company will be abdicating the throne!

Why am I confident that MMM will reduce their dividend and reduce it to a greater degree than what might be considered an acceptable reduction recognizing the rather sizeable spin-off of their health care business, now known as Solventum Corp [SOLV]? From the 2024Q1 earnings conference call transcript:

Paying a competitive dividend has been a priority for 3M for more than 100 years. This will continue to be true following the spin-off of Solventum. As a part of the spin, we distributed 80.1% of Solventum’s outstanding shares to our shareholders, and post-spin have made the decision to reset 3M’s dividend. As a result, we anticipate a dividend of approximately 40% of adjusted free cash flow. This represents a dividend that is in line with our industrial peers and well above the S&P 500 median, with the potential to increase over time.

Source: 3M Chairman and Chief Executive Officer, Mike Roman delivering comments on Slide 17 of the 2024Q1 Earnings presentation deck.

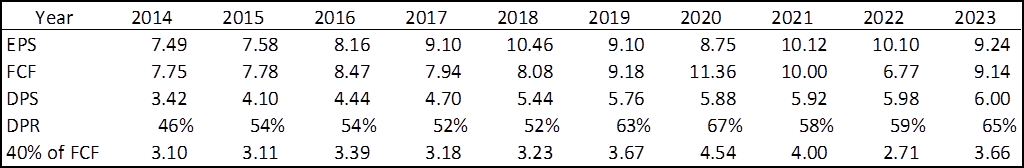

There is a remote possibility that adjusted free cash flow [FCF] is substantially higher than what it has been, especially now that they spun off SOLV. The table below shows that at no time in the last decade has ‘40% of the adjusted FCF’ been as high as the dividend they actually paid.

Of course, all other things being equal, the free cash flow will only be lower going forward. So, barring a management change of heart, miracle performance, or an unprecedented tough stance by a board of multimillionaires, there will be a lower dividend going forward.

Now, if MMM were to lower its annual dividend in a proportional manner to reflect the spin-off value based on the closing stock prices at the time, it would go from $6.04 to approximately $5.06. In theory, this might not be considered as a dividend reduction by the authorities because shareholders could have immediately sold their shares of SOLV and purchased more shares of MMM, maintaining their level of income. This is essentially what Royal Dividends did.

Alas, there is no mention of such a strategy. Further, it is unlikely to happen coincidentally because 40% of the adjusted FCF will likely be lesser than the $1.27 quarterly dividend in such a scenario.

And so, the 8th ranked Dividend King, with a massive 66-year annual increase streak will join the ranks of the great unwashed.

Does MMM Need to Reduce its Dividend?

The quarterly dividend as of right now is $1.51. Using the 2024Q1 adjusted EPS of $2.39, we have a dividend payout ratio (DPR) of 63%. More conservatively, the unadjusted GAAP EPS of $1.67 produces a DPR of 90%. That’s in the danger zone, but the dividend is covered using the EPS metric. They reported an adjusted FCF of $0.8 billion and stated that they paid $835 million in dividends. So, it would appear that all of the free cash flow went out the door to pay dividends.

They did not provide a forecast of adjusted FCF for CY2024, but they did provide a guidance range of adjusted EPS of $6.80 to $7.30. And if we glance at the table above just one more time, we can see that FCF and EPS track each other pretty closely over time. In other words, it isn’t too much of a stretch to see that the dividend would be covered for some time to come.

Thus, the answer to the question is ‘no’; they do not need to reduce the dividend. I hate to say it, but it looks to me that they’re using the spin-off to justify the dividend reduction.

What’s Next?

Investors brimming brightly with optimism and verve, like me, naturally look to the future and want to know which company will replace the Dividend King that has chosen to abdicate the throne. It just so happens there are still 11 Dividend Kings that do business in the Industrials sector and there is no need to add another Industrial as we would if there were fewer than 5 Kings.

Incredulity does not begin to describe how I feel about seeing two Dividend Kings abdicate the throne on the same day, let alone two in the rather small Royal Dividends portfolio. Whereas LEG plummeted on the news and its performance in the portfolio has been atrocious, MMM rose a little on the news and as a result finally turned the corner in the portfolio, showing a small positive return of 3%. That being said, once MMM declares a substantially lower dividend the result will be the same. Eventual removal from the portfolio is an absolute certainty because MMM will no longer qualify for inclusion in the Empire.

The option to let it go now at a small profit is tempting and I am not rejecting that idea just yet. However, I didn’t start this portfolio to settle for small gains. I am after sick, inexplicably high returns2. The MMM position will be addressed soon enough, and it will involve an assessment of its current price relative to a post spin-off estimate of its fair value.

For now, it will remain in the portfolio, but just as with LEG, the hourglass has been flipped.