According to Chuckles Schwab, ‘dollar cost averaging is the practice of investing a fixed dollar amount on a regular basis, regardless of the share price’.

As they go on to say, ‘it is a good way to develop a disciplined investing habit’. It is also a good way to achieve average returns. We can do better.

Dollar Cost Averaging at Work

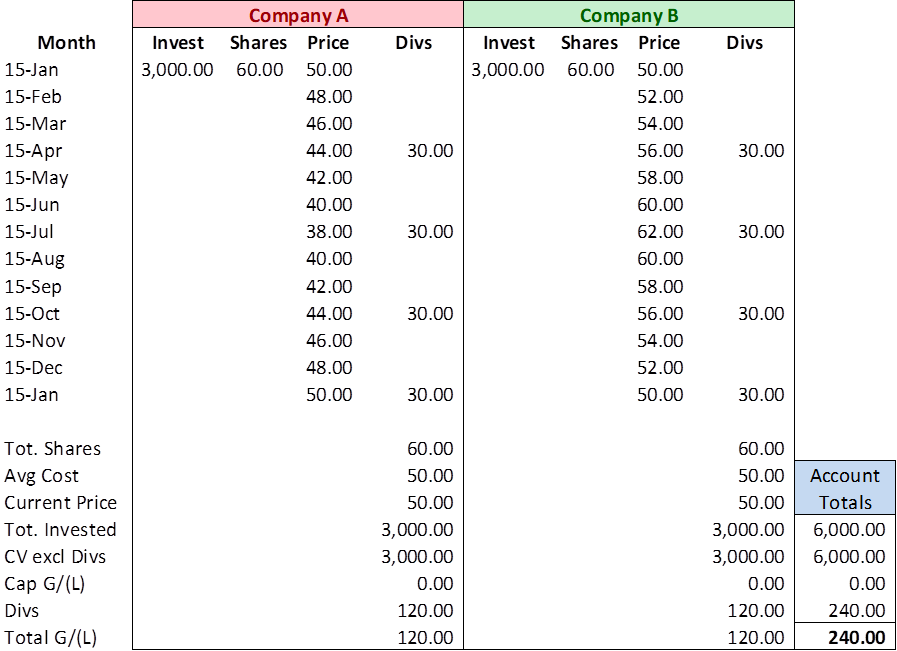

Suppose an individual wishes to invest $3,000 into each of two dividend paying companies, Company A and Company B, each yielding 4%. Let’s see how the year plays out.

Mid-way through the year Company A found its stock down -24%, while Company B was up 24%. Both companies have reverted back to the entry price paid by the investor. However, because both companies pay a very nice dividend, our investor’s account is up 4% or $240 a year later.

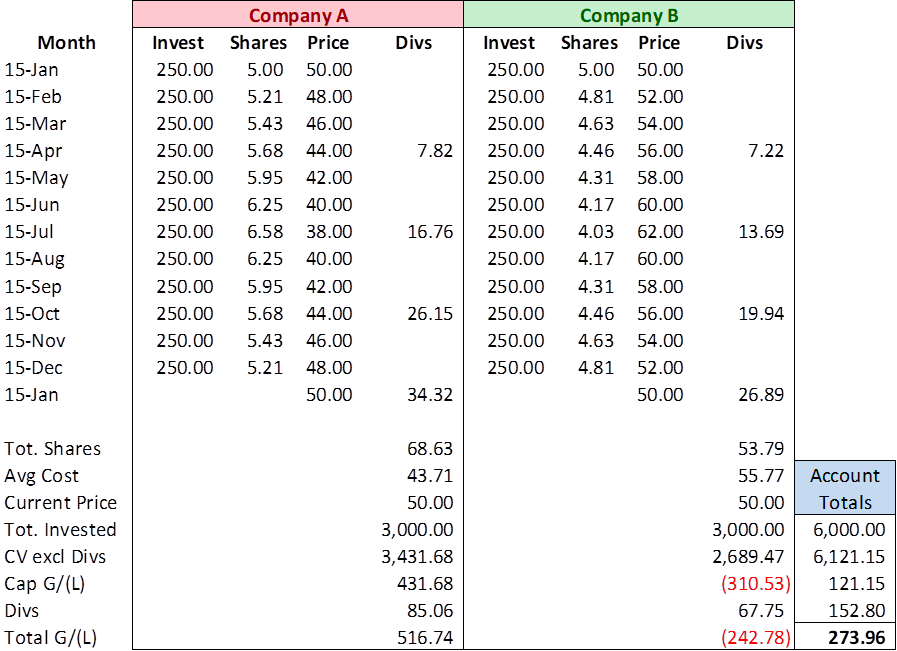

What if the investor had some doubts about the share prices before he purchased his shares? What if he had no real idea about what direction the market would take? He could choose to spread his $6,000 investment over the whole year, investing $500 each month, $250 into each company.

Because he gradually rolled out his investment, he does not get all the dividends he would have collected had he invested all $6,000 up front. And even though one company first shot up and then all the way back down, and the other did the exact opposite, the account is up nearly $34 more under this scenario!

The power of grabbing more shares on sale, more than offsets the disadvantage of having acquired more shares at what turned out to be a premium.

Had there been no dividends paid, the effect would be even greater. There would have been $0 total gain in the first scenario and unrealized gains of $121.15 in the second.

Don’t get upset with the fractional shares. I did it to keep the mathematics pure. Doing so would not have changed the conclusions drawn. If you have to, pretend that these are two mutual funds or pretend the account is in a brokerage that allows for fractional shares.

Is it obvious that if all a stock ever does is climb, then investing all you have up front is optimal? Yes. But how would you know? Likewise, would someone routinely sinking money into a stock that goes down indefinitely be worse off than someone who simply stuck to their initial investment? You better believe it. Sure, those two scenarios make dollar cost averaging seem like a bad idea. And so, you improvise, you overcome, you adapt.

A Little Love where it’s Needed

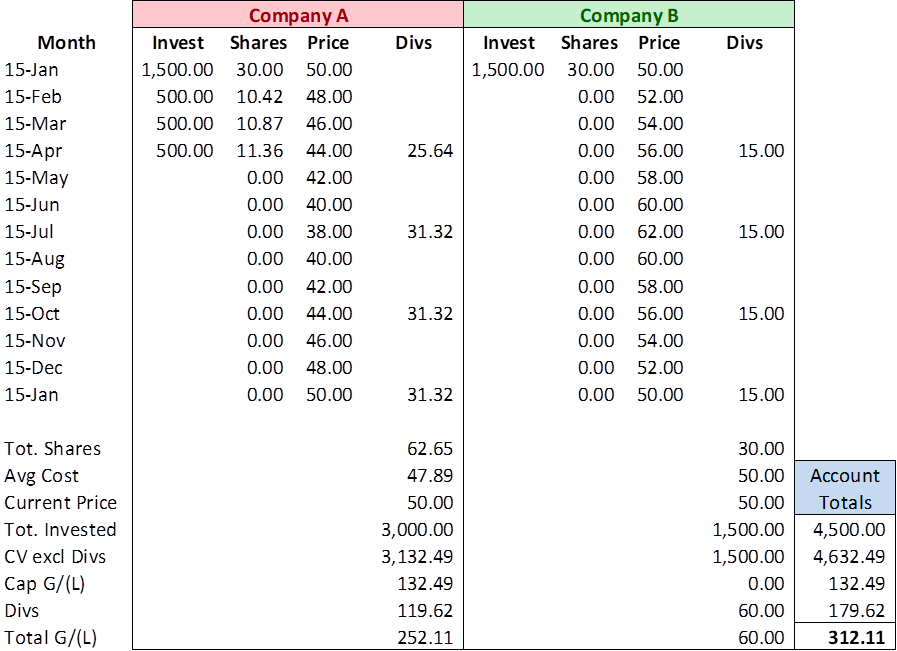

What if instead, the investor decides to invest half of his money now, equally into Company A and Company B, with the idea that if one should drop in price, he’ll ‘average down’, lowering his cost per share until the share price comes back? Let us suppose further that he won’t sink money into a loser forever and decides that once he’s invested twice as much into the ‘needy’ company he’ll stop investing more.

Now we’re talking. Instead of $250 going into each after the initial, larger investments, the $500 available for the month went into Company A. This continued as Company A’s price fell each month, until a total of $3,000 had been invested – twice that which had been invested in Company B to date.

A year later, our investor still has $1,500 in cash (not shown in the account). In other words, by averaging down intelligently (buying low and getting more shares for his money), he’s managed to grow the account even more than in the other two scenarios, and 25% of his money was never invested. Company A started to bounce back a couple of months later, but this could not have been known in advance. It was prudent to stop at a pre-defined limit and served to manage overall risk rather well.

The Best Way to Dollar Cost Average

Traditional dollar cost averaging emphasizes regular fixed dollar investment, ignoring stock price completely. The first positive, is the regularity of it – the discipline of saving/investing at regular intervals. The second positive is that you will buy more when the price is lower. Mathematically, one will acquire more shares when the stock is relatively low and less when the stock is relatively high. Traditional dollar cost averaging is done across all one’s investments equally.

Averaging down focuses the additional investments into only stocks whose prices have fallen in an attempt to bring their average cost closer to their current share price. This seems intuitive. We will never be sure of what direction the market will take in the short to mid-term. But we can always look at our current positions and see which ones have done well and which ones haven’t. But averaging down increases one’s risk. Afterall, investing more money in falling stocks is a contrarian approach – what if the masses are right? If those stocks continue to fall, your unrealized losses magnify.

This is where we need to focus on the needy, but not get greedy.

Dollar Cost Averaging 2.0

- Regularly invest a fixed dollar amount into your portfolio.

- Choose the stock with the highest expected total return.

- Purchase additional shares, but not to the point a stock or sector becomes overweighted.

Royal Dividends has laid out its details for all three of the bullets above for its portfolio in the September 29, 2022 post titled “Going Forward”. A quick comment on #2. If a stock’s price has fallen, but its expected earnings growth and dividend has not changed, its expected total return will have increased. Thus, it is not uncommon for the stock whose price action has performed the worst to be the most worthy of additional investment. This is not always the case though. Sometimes, a stock has fallen because of its own lousy performance and its outlook has changed for the worse. Unless the stock price has fallen to a point that is grossly disproportionate to the stock’s current value, this is a stock not worthy of further investment.

So be careful. Even though it is often the case that it is the stock whose price has fallen the most that will get the additional investment, it is not because it has fallen the most. It will be because the only thing that has changed about the company is its price. Nothing else. The earnings capacity is still the same. The dividend and its safety have not changed. The outlook has not changed. This is a company that has gone on sale. This is a company in which we want to increase our ownership.