The Consumer Discretionary sector has returned -23.24% this year. That is the third worst behind Information Technology (-26.31%) and Communication Services (-34.18%). I’ve avoided selecting a King from this sector for weeks because discretionary businesses typically do not thrive in recessions. But it’s time to dip our toes in the water. And we want a company that is steady and resilient. I found one.

Come Monday morning, Leggett & Platt Inc [LEG] joins the Portfolio for the Ages.

Leggett & Platt Inc

This Dividend King started 139 years ago in 1883 when American Inventor J.P. Leggett developed the idea for a steel coil bedspring and partnered with a blacksmith by the name of C.B. Platt. Their company eventually went public and traded over the counter in 1967. Then in 1971, just before ‘going to the mattresses’ became a famous line, they began a streak of increasing the dividend every year that continues to this day. The stock price has dropped half the amount of the broader sector so far this year (-12.5%) and it was slightly undervalued at the start of the year to boot.

LEG likes to say that while they are lesser known, people use their products ‘everyday, everywhere’. They’re lesser known because their products are sold to other manufacturers whose names you would recognize. Names like: Ashley Furniture, Ford, General Motors, Home Depot, Lowe’s, Volkswagon, and Walmart.

Here is the profile from TD Ameritrade:

Leggett & Platt, Incorporated is a manufacturer that conceives, designs, and produces a range of engineered components and products found in many homes and automobiles. The Company’s Bedding Products segment supplies a variety of components and machinery used by bedding manufacturers in the production and assembly of their finished products, as well as produces private label finished mattresses for bedding brands and adjustable bed bases. Its Specialized Products segment supplies lumbar support systems, seat suspension systems, motors and actuators, and control cables used by automotive manufacturers. This segment also produces and distributes tubing and tube assemblies for the aerospace industry and engineered hydraulic cylinders used in the material-handling and construction industries. Its Furniture, Flooring & Textile Products segment supplies a range of components for residential, and work furniture manufacturers, as well as select lines of private label finished furniture.

I have been on the websites of dozens of companies in the last two months doing research for the pick each week. Leggett & Platt has great content, and I could not be more impressed.

Before I go any further, for the love of God, go to their website and check out their 112-page Fact Book and their 176-page History Book, The Legend of Leggett & Platt. No, I am not joking.

The Details

Data as of 2022-09-17

| Name | Leggett & Platt Inc |

| Ticker | LEG |

| Website | Investor Relations |

| Sector | Consumer Discretionary |

| Dividend Streak | 51 years |

| Last Price | $36.28 |

| Div Amt (quarterly) | $0.44 |

| Ann Dividend | $1.76 |

| Last Ann Div Inc | 4.9% |

| Dividend Yield | 4.9% |

| Payout Ratio (ttm) | 62.0% |

| Beta (5-yr, mon) | 1.32 |

| P/E Ratio (ttm) | 12.77 |

| Margin of Safety | 17.1% |

We’re adding LEG to the portfolio for three reasons:

- The P/E Ratio of 12.77 is well under their 10-year historical average of 18.

- Their dividend is just shy of 5% and the payout ratio is at a safe level.

- It is in the Consumer Discretionary sector and holding up very well in a terrible market.

Time to Shine

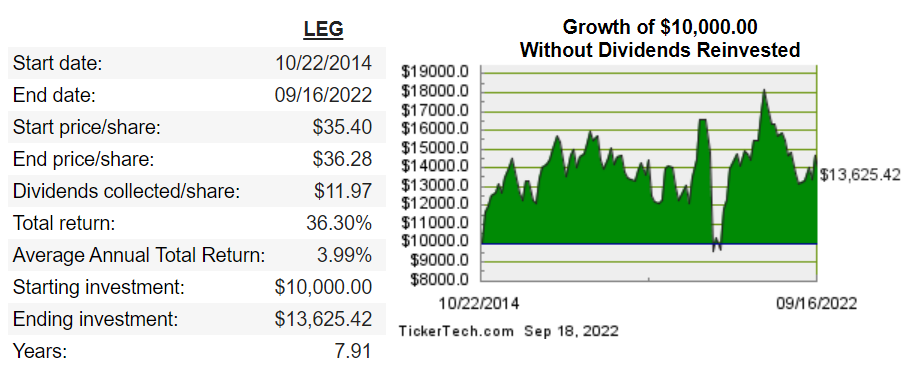

If you look at the chart below, you’ll see that LEG is trading at the same level it found itself in late 2014. On October 22, 2014, LEG closed at $35.40. It gapped up to $37.03 to close on October 23, 2014. Almost 8 years have passed and we’re here again.

But we know better. We know that though the price has barely changed, there have been 8 years of glorious dividends. They’ve been a big help.

LEG has returned just under 4% per year for the last 8 years. However, their EPS of $2.84 over the last four quarters is 60% greater than the $1.78 EPS for CY 2014. Going forward, I expect LEG to overperform the general market, just as they are outperforming the Consumer Discretionary sector right now.

LEG has the highest beta (1.32) of any of the companies in the portfolio right now, but the entire portfolio is still under 1.

This Monday, I will be placing a market order for 28 shares of the legendary Leggett & Platt Inc.