This week, 6 of the 19 portfolio holdings ranked in the Top Ten: BDX, GRC, PII, PPG, SJW, and TGT.

| Ticker | Account Value |

| BDX | 1,816.02 |

| GRC | 2,974.38 |

| PII | 1,609.28 |

| PPG | 2,820.44 |

| SJW | 3,365.46 |

| TGT | 2,690.62 |

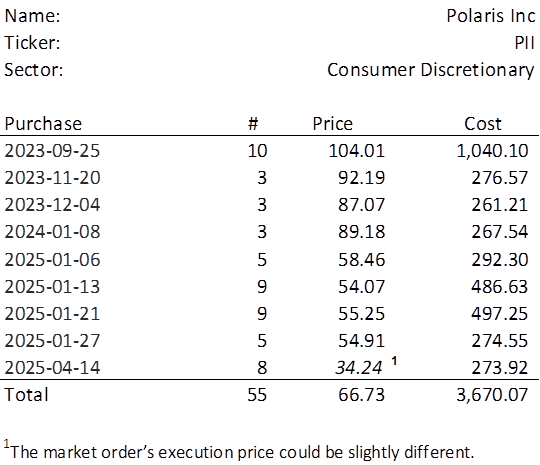

The lowest amount belongs to PII which last traded at $34.24. Therefore, I will acquire 8 shares of PII on Monday. Below, is the purchase history and average cost calculation.

2024Q4 EPS has been announced since we last invested in PII, so it is time to examine why we still continue to flush money down this toilet.

Observations

Stock Price

It didn’t take long for PII to not only return all the way to the magnetic $37 price level, that I discussed in my 2025-01-11 post, it even fell through that level on the threat of tariffs/the postponement of tariffs/the increase of tariffs. Take your pick.

The stock price won’t turnaround until earnings turn around. This is unlikely to happen in 2025.

Earnings

Magnitude/Trend

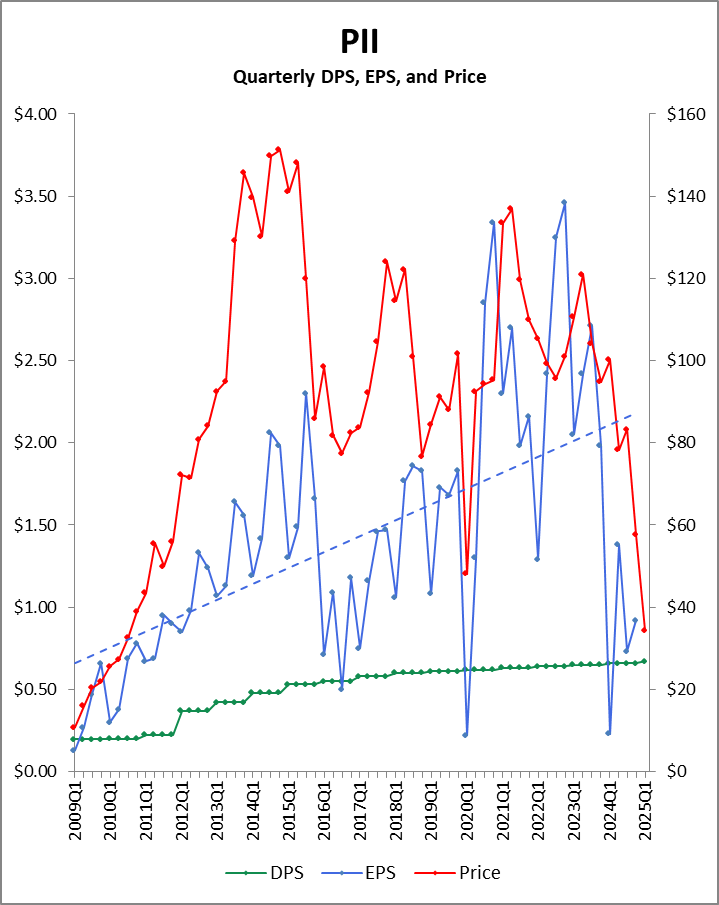

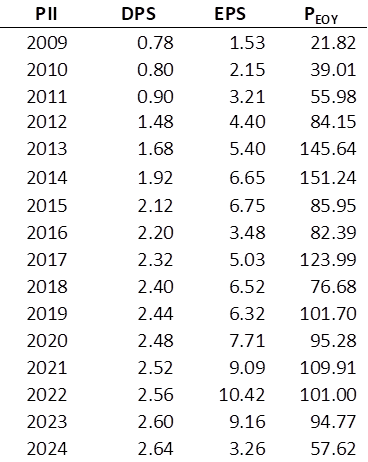

In the first 6 years of the chart above we can easily see a certain seasonality to the EPS and also a relatively low volatility surrounding a positive linear trend. However, the last ten years has seen a massive increase in volatility and that obscures whatever EPS trend there might be and any quarterly seasonality that underlies those earnings. Suffice it to say, the linear trend line shown is inappropriate as a ‘summary’ of how EPS has performed. At times like this it helps to look at a table, like the one below. The truth is that CY2024 EPS of $3.26 on an adjusted basis was a shade ahead of where CY2011 came in. At year end, before these earnings were even announced, the stock was essentially trading at the same price level as it had when it closed out CY2011.

Now of course, the stock closed on Friday, some 42 days later at $34.24. So, what happened?

From the 2025-01-28 2024Q4 earnings press release: “Polaris announced full year 2025 sales and adjusted earnings guidance with full year sales expected to be down 1 to 4 percent and full year adjusted earnings per share expected to be down ~65 percent, both sales and adjusted earnings per share are compared to full year 2024.”

Guidance suggests CY2025 EPS will come in around $1.10 to $1.15. That’s depressing and a throwback to the days of the Great Recession. Such is the reality in the world of uncertain tariffs and the threat of recession for a big-ticket item consumer discretionary company like PII. Hopefully, demand for their products is reaching a trough.

Seasonality

There still exists a seasonality to the quarterly earnings.

In the 16 years above, Q1 averages 16% of the yearly total. Q2 averages 24% and the final two quarters 30% each. With even less variance, H1 (the first half) is typically 40% and H2 is typically 60%.

Dividends

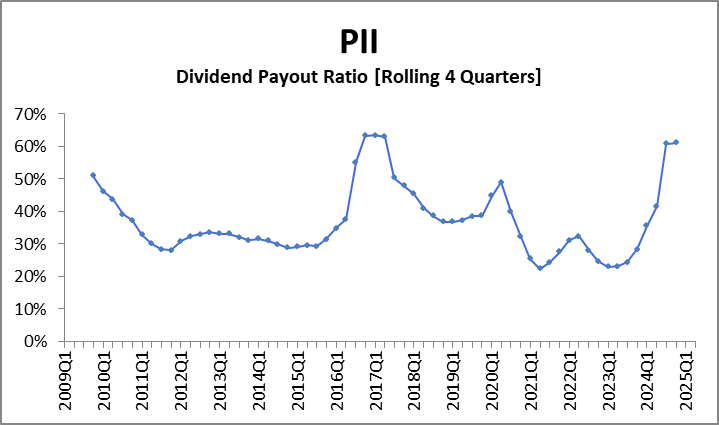

CY2024 dividends were well covered but at the high end of the payout range.

Unfortunately, expected CY2025 EPS around $1.15 won’t come close to covering the $0.67 quarterly dividend. And this is where we get to see what PII is made of. They are a Dividend Aristocrat with a 30-year dividend increase streak. Last year, we saw Dividend Kings LEG, MMM, and TDS all abdicate the throne. And Walgreens Boots Alliance [WBA], which was not in the Royal Dividends portfolio, terminated a 48-year streak and will be purchased and taken private by the end of this year. Will PII tough it out? From the earnings call on 2025-01-28:

Our capital deployment priorities start with investing in our core business. Our second priority is preserving our dividend as we have raised the dividend for 29 consecutive years. In 2025, we intend to put a higher priority on paying down debt. As we focus on working capital improvements and plan for lower capital expenditures, we expect 2025 to be a strong year of cash generation. – Robert Mack, CFO

Two days after this statement, the board of directors increased the quarterly dividend 2% marking the 30th consecutive year of dividend increases. That’s a good start.

Thoughts on Investment

The relative strength indicator in the dark themed price chart above suggests that PII is in oversold territory on a monthly basis and clearly, this does not happen often. For a company with promise, this is a great time to add shares.

Tariffs are a real concern, and much discussion took place around them during the earnings call on 2025-01-28. Here’s a quote of concern:

Note that our guidance does not assume a change in regulatory policy, which includes tariffs. – Robert Mack, CFO

Read fast or only half-listened to, it would sound like the guidance includes the impact of tariffs. Carefully read, it is clear that the 65% reduction in earnings for 2025 does not take into account all the tariff noise since this call took place.

As you know, it changes by the hour. As of yesterday, we were hearing that it’s far more targeted around specific areas like semiconductors, but there’s no telling where things could go. I’m sure there’ll be some short-term things that may get pulled back because they’re being used as a negotiating tactic. So at this point, we’re staying focused on the things we can control within the business.

We’re less than $0.5 billion worth of revenue into Canada, and we import less than $50 million into the U.S. What I would tell you is for China, we have been working since the original set of tariffs were put in place. We’ve pulled down considerably by about a couple of hundred million dollars, the amount that we’re procuring out of China. The team has plans in place. As we’ve talked about, this is not stuff that you can do overnight. These supply chains have been established for decades. But we’ve been working with our Chinese suppliers. Our sourcing organization has worked aggressively to find alternative supply.

We’re going after an aggressive amount during 2025. And then, we obviously have plans identified for ’26 and ’27. The list gets harder and harder as we get lower and lower into the components that we would be going after. And that’s what we’re going to be focused on. I would say that we have relative to the rest of the power sports industry up and to this point, been incredibly disadvantaged. We’re the only U.S. manufacturer yet we’re the only ones paying tariffs. Some of our competitors, three of them specifically have pretty heavy manufacturing bases down in Mexico.

And obviously, we would be impacted, but they would be more impacted, some of which have almost all their manufacturing coming out of Mexico. So it’s a volatile environment. We’re going to stay focused on the things that we can control as it relates to how much we’re procuring out of China. And we’re going to do what we can to help influence policy where appropriate.

– Michael Todd Speetzen, CEO

These were not prepared remarks, but a response to an analyst. As professional as that response was, I think you can feel the frustration. And this was before the madness of the last couple of weeks!

Honestly, I think PII is worthy of additional investment at this time despite the stock price having dropped 67% since opening the position and 75% since July 2023. Stock price isn’t the same as business. The business is still profitable and is making adjustments, doing its best to navigate what could very well be more difficult times ahead.

They are excellent at capital management with a fairly wide moat; if any company in the recreational vehicles business overcomes the adversity on the field, it will be this one.