This week, three of the portfolio holdings ranked in the Top 10: FMCB, PPG, and SJW.

| Ticker | Account Value |

| FMCB | 3,195.00 |

| PPG | 3,515.96 |

| SJW | 3,338.37 |

The lowest amount belongs to FMCB. Earlier this week I placed a GTC limit order to acquire another share of FMCB at $975 (see 2024-12-01 post) and that order has not executed. The truth is, acquiring one more share of FMCB at its current price of $1,065 would create a position imbalance within the portfolio, leaving only ABBV, PII, EPD, FRT, and NNN eligible for additional investment. Unfortunately, none of these positions made the Top Ten. That can only mean one thing:

It is time to add a new position to the Portfolio for the Ages!

In addition to the usual $1,000 with which a new position is begun, there is $271.37 of income to reinvest. Once that money is invested, position balance will be restored and, theoretically, a new share of FMCB could be acquired for a price even as high as $1,387.50 before throwing the portfolio off balance again. Of course, at that price it would be nearly fully valued and would fall out of the Top Ten accordingly.

I don’t see FMCB leaving the Top Ten any time soon and so for now, I will keep the limit order to acquire one more share of FMCB for $975.

As is tradition, no investments will be made over the following three weeks in order to restore the $250+ per week pace of investment. These ‘off’ weeks will be a perfect time to let that FMCB order work. And as I explained in the 2024-12-01 post, I may very well adjust the limit order if I feel a local minima has been achieved. I should also mention that I could easily remove the limit order in a month, because it is very likely that the new addition to the portfolio will also be in the Top Ten and there is a high probability that it would have the lowest account value – knocking FMCB out of consideration1.

Now, as has already been revealed by the ticker symbol in the title, BDX is the new addition. It was the highest ranked stock not already in the portfolio and opening a new position in BDX does not create a sector imbalance.

Becton, Dickinson and Co.

The profiles available on Yahoo! Finance and Charles Schwab appear to be identical. It is heavy on the medical equipment terminology, so I went a different route.

Here is the profile from the company’s own website:

BD is one of the largest global medical technology companies in the world and is advancing the world of healthTM by improving medical discovery, diagnostics and the delivery of care. The company supports the heroes on the frontlines of healthcare by developing innovative technology, services and solutions that help advance both clinical therapy for patients and clinical process for healthcare providers. BD and more than 70,000 employees have a passion and commitment to help enhance the safety and efficiency of clinicians’ care delivery process, enable laboratory scientists to accurately detect disease and advance researchers’ capabilities to develop the next generation of diagnostics and therapeutics. BD has a presence in virtually every country and partners with organizations around the world to address some of the most challenging global health issues. By working in close collaboration with customers, BD can help enhance outcomes, lower costs, increase efficiencies, improve safety and expand access to healthcare.

The Details

Data as of 2024-12-08

| Name | Becton, Dickinson and Co. |

| Ticker | BDX |

| Website | Investor Relations |

| Sector | Health Care |

| Dividend Streak | 53 years |

| Last Price | $220.02 |

| Div Amt (quarterly) | $1.04 |

| Ann Dividend | $4.16 |

| Last Ann Div Inc | 5.7% |

| Dividend Yield | 1.9% |

| Payout Ratio (ttm) | 29.6% |

| Beta (5-yr, mon) | 0.41 |

| P/E Ratio (ttm) | 16.72 |

| Margin of Safety | 24.5% |

Reasons to Invest

There are five health care companies in the Empire: ABBV, ABT, BDX, JNJ, and MDT. The portfolio will now hold ABBV, BDX, and MDT. To be sure, BDX and MDT are perhaps best matched as competitors, but there is overlap among all of these great companies. I stress the word great here, because some might ask, why exactly we need another company like MDT in a portfolio with only 19 (now) stocks. The answer is simple. It isn’t ‘need’ per se, but an opportunity to add another great company, with a massive international presence, from an industry that is recession resilient.

In the last sentence, you have three reasons: greatness, international, and recession resilient.

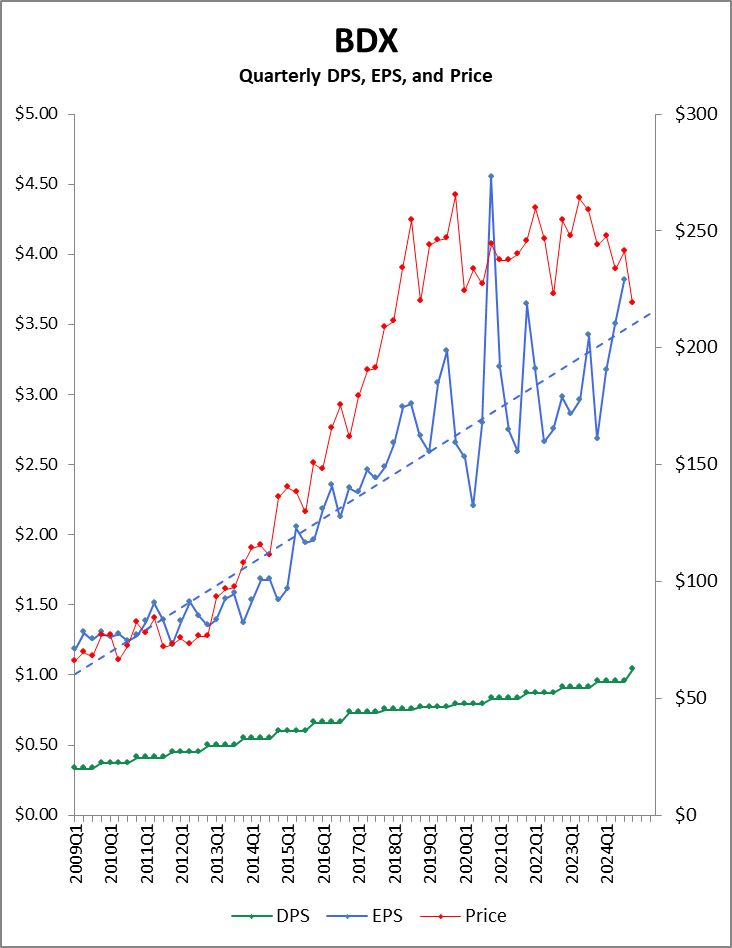

Let’s add to that dividend history, dividend safety, and massive potential upside. BDX has been trading between $200 and $270 for 7 years. However, Sure Dividend places their fair value at $274 and Morningstar at $325. This is a stock that could trade at $400 five years from now.

Sure, maybe the price got ahead of itself pre-pandemic, but stalling all that time since? Falling from $250 even as each of the last three quarters have seen EPS increase? Sounds like opportunity.

BDX last traded at $220.02 per share. Five shares bring us to $1,100, but the additional $271.32 available for reinvestment allows one more share to be tacked on. I am placing a market order to buy 6 shares of BDX on Monday.

- It is fair to ask why I am allowing the limit order on FMCB to continue working, given there is a procedure, I am following said procedure, and in so doing, an additional share of FMCB becomes unnecessary. FMCB is prone to euphoric spikes due to its illiquidity. When so many buyers just cannot live without FMCB, the appreciably lower number of sellers jack their prices up rapidly. But the effect has historically worn off within a few weeks. Had FMCB not just recently spiked, getting it for a market price of anywhere between $960 and $1,000, where it had been trading for weeks, would not have caused an imbalance in the portfolio.

I will not let what I believe to be a temporary phenomenon due to illiquidity throw off what would have been the natural order of things at Royal Dividends. The GTC limit order allows the patient investor to set his or her price and potentially right the wrong created by impatient investors. ↩︎