This week, four of the portfolio holdings ranked in the Top Ten: FMCB, PPG, SJW, and TGT.

| Ticker | Account Value |

| FMCB | 2,907.90 |

| PPG | 2,886.96 |

| SJW | 2,956.34 |

| TGT | 2,995.60 |

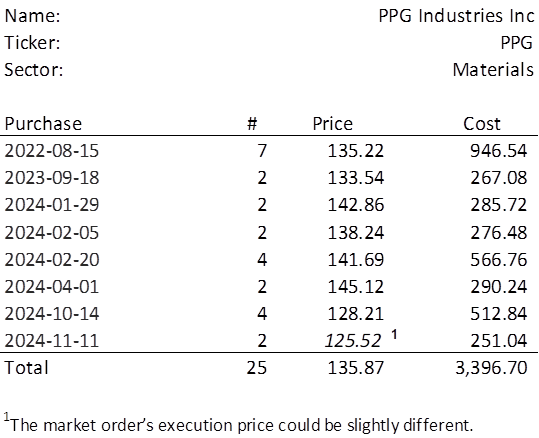

The lowest amount belongs to PPG which last traded at $125.52. Therefore, I will acquire 2 shares of PPG on Monday. Below, is the purchase history and average cost calculation.

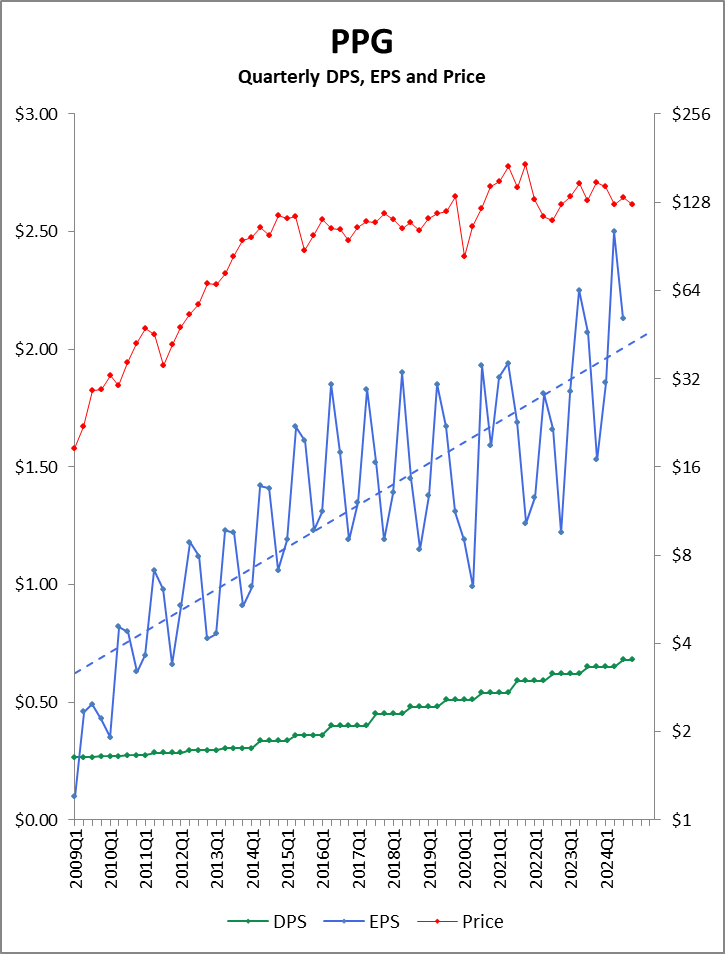

Let’s take a quick look below at the most recent performance in the context of the last 16 years.

Observations

- PPG earnings exhibit strong seasonality. A typical year sees a low first quarter, a high point in the second quarter, a third quarter with a slight drop off, and finally a fourth quarter that is perhaps on par with the start of the calendar year or perhaps a little lower.

- The last three quarters have been the very best start to a calendar year in PPG’s history.

- The current price of $125.52 is lower than where it ended CY2019 at $133.49. Yet, the low point of PPG’s CY2024 earnings guidance of $8.15 would be 30%+ higher than the earnings of 2019.

- It would appear that PPG’s price has remained flat even though EPS growth has really begun to move. Sure Dividend puts a fair value of $156.00 on PPG and I cannot disagree.

- Note the steady climb of dividends and their relative safety – even the lowest quarters have the dividend easily covered.

While sales revenue is essentially flat over the last two years, EPS is a different matter. PPG just had its best second quarter ever and its best third quarter ever. The low end of their earnings guidance of $8.15 implies fourth quarter EPS of $1.66 – a record fourth quarter. It seems the invisible hand of economics is pressing down on PPG like one does with a spring. When the hand comes off, look out.