This week, five of the portfolio holdings ranked in the Top 10: BKH, FMCB, MMM, MO, and PPG.

| Ticker | Account Value |

| BKH | 2,207.44 |

| FMCB | 2,922.63 |

| MMM | 2,129.34 |

| MO | 2,428.46 |

| PPG | 2,392.41 |

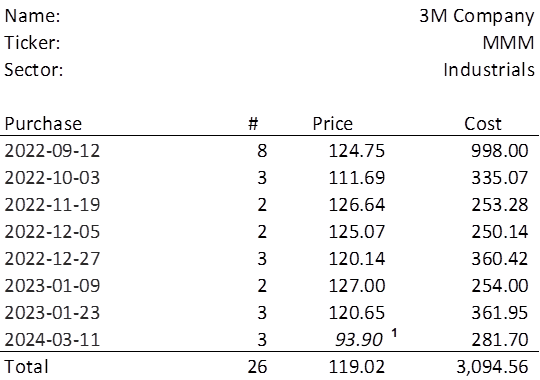

The lowest amount belongs to MMM which last traded at $93.90. Therefore, in order to invest a minimum of $250 in MMM, I need to purchase 3 shares on Monday. Below, is the purchase history and average cost calculation.

An Old Friend

It has been over a year since I added to the MMM position in the portfolio. It has never left the Top 10 because it is significantly undervalued. Undervaluation means that we can expect the price to revert to a more appropriate valuation over time, seen as an increase in the P/E Ratio, all other things being equal. The earnings multiple increase, along with expectations of future earnings growth and the dividend yield, are the three components of expected total return. MMM has a five-year expected total return of 20.5% per annum.

Now, we know the price of MMM has sunk 22% since the last investment. So much for reversion so far. But how has the company actually performed?

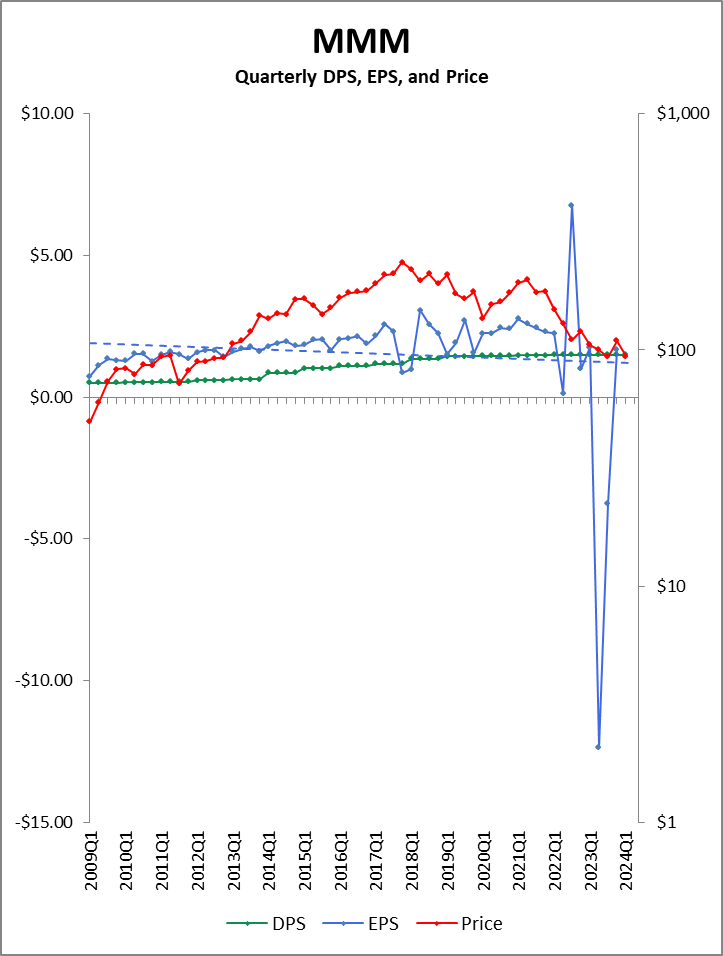

Well, well, well. It seems MMM had quite the year. Should you be surprised that the only negative quarters in the last 15 years (a) came immediately after MMM was added to the Portfolio for the Ages and (b) were massively negative? Absolutely not. An investor needs to shed incredulity and get comfortable with the idea that if the entire market can move beyond the limits of imagination, and it routinely does, then an individual stock can do the same and then some.

MMM was attractive back in September of 2022 largely because its higher potential returns came with higher risk in the form of ongoing litigation in several areas, and we were aware of this. I won’t go into detail on those cases here but know that as some of those cases have progressed, the liability incurred by MMM has begun to take shape.

For instance, 2023Q2 EPS came in at $(12.35). It included a proposed settlement agreement with public water systems in the United States regarding PFAS resulting in a pre-tax charge of $10.3 billion payable over 13 years, negatively impacting EPS by $14.19. On a non-GAAP basis, 2023Q2 EPS was $2.17.

2023Q3 EPS improved to $(3.74). This included a pre-tax settlement charge of $6 billion related to military grade earplugs. The non-GAAP, adjusted EPS was $2.68.

The fact of the matter is that ongoing litigation in several areas remains, and it serves to keep the stock price depressed. But MMM is proving adept at (a) minimizing the settlements and (b) spreading the actual settlement payments over multiple years. This makes these obligations manageable to the company. As more of these settlements are settled (intended), the weight of their mystery impact will be gradually lifted from the shoulders of this giant and the stock price should move higher once again.

What, Me Worried?

A lesser company might have cut their dividend already or might be planning to do it imminently, but we’re talking about a 66-year streak. How many other companies could weather the blow of $16 billion in legal damages and get right back up? The many years of future settlement payments may have to be recognized all at once on a GAAP basis, but the adjusted earnings give us insight into how well the dividend is covered. The quarterly dividend of $1.50 was still well covered in the two quarters discussed above and in the final quarter of 2023 as well, which you’ll note was a return to more normal earnings levels.

I suppose I could say that I chose to present the GAAP earnings rather than the non-GAAP, adjusted earnings in the chart above because they best reflect the magnitude of the settlements that MMM has endured. While that is true, the three real reasons are: (a) this data was free, (b) I am fairly lazy when it comes to volunteer endeavors, and (c) for crying out loud there used to be consistency to the GAAP numbers, and over such a long period, the adjusted earnings would not likely have shown a different trend.

So, just imagine a smoother graph of EPS over CY2023 totaling $9.24. This means MMM is selling for a P/E Ratio of 10. It used to trade at a significant premium to that of the P/E Ratio of the broader market (a P/E Ratio between 15 and 22). Supposing zero growth in earnings, a multiple increase to just 15 means MMM could trade near $150. In the meantime, we’re lowering our average cost to under $120 with this purchase on Monday and collecting a $1.50 quarterly dividend, a 5% yield on cost.