This week, five of the portfolio holdings ranked in the Top 10: BKH, MMM, NFG, PII, and PPG.

| Ticker | Account Value |

| BKH | 1,828.80 |

| MMM | 2,207.77 |

| NFG | 1,619.08 |

| PII | 1,736.03 |

| PPG | 1,287.36 |

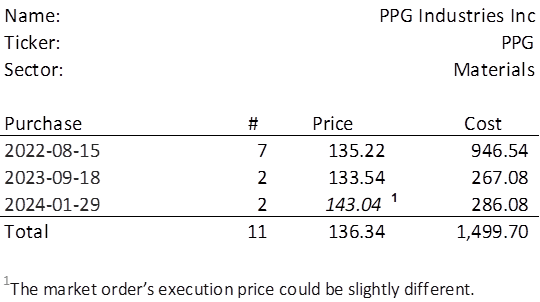

There is currently an overexposure to the following positions: FMCB, QCOM, and TDS. Had any of these made this week’s Top 10, they would not be eligible for additional investment. The smallest position above is PPG and it last traded at $143.04. Therefore, in order to invest a minimum of $250 in PPG, I need to purchase 2 shares on Monday. Below, is the purchase history and average cost calculation.

PPG has made it into the Top 10 despite actually performing fairly well since it was added to the portfolio in August of 2022, a total return of 6.5%. This surprised me. It turns out that their adjusted EPS of $7.67 for FY2023 is a record. Further, they provided FY2024 guidance for adjusted EPS of $8.34 – $8.59, the midpoint of which would represent 10% growth. That growth is a significant component of their expected total return over the next few years and that is how it came to be in the Top 10.

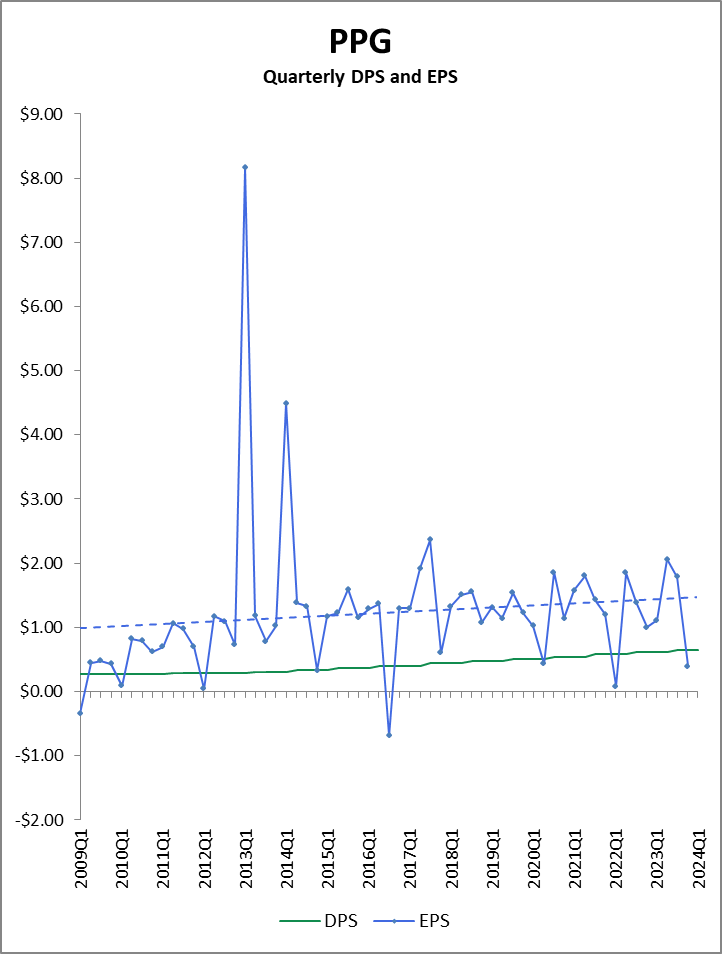

Since we haven’t added to PPG since 2023-09-18, let’s take a quick look at some historical data. There is significant volatility to the quarterly earnings per share (EPS). On occasion, those earnings dip below what is paid out in dividends. This last quarter was one of those times, but for the whole of the year the payout ratio was still under 50%. Overall, the EPS have trended upward over time (dotted blue line). The dividends per share (DPS) are well supported and have been climbing at about the same pace.

The EPS above are on an unadjusted, GAAP basis. The 2023Q4 EPS of $0.38 shown above translates to $1.53 on an adjusted basis. I understand the interest in carving out the effects of one-time events that would otherwise create a misleading picture, but I find that one-time events happen every quarter. Over longer periods, it shouldn’t matter for determining the trend. PPG’s dividend is well covered, and I wouldn’t be surprised if they increase it significantly in 2024. Further, there’s a little upside in the price movement should they actually deliver on their 2024 projection. It’s a good time to pick up a couple of shares.