This week, five of the portfolio holdings ranked in the Top 10: BKH, MDT, MMM, PII, and TGT.

| Ticker | Account Value |

| BKH | 1,076.46 |

| MDT | 1,342.49 |

| MMM | 2,206.85 |

| PII | 1,177.41 |

| TGT | 1,314.60 |

As of this writing, the portfolio no longer has a sector imbalance. However, there is currently an overexposure to the following positions (tickers in bold made the Top Ten this week): FMCB, MDT, MMM, MO, NC, QCOM, and TDS. None of these tickers are eligible for additional investment at this time. No matter, the lowest amount belongs to BKH and it is eligible for an investment of additional funds.

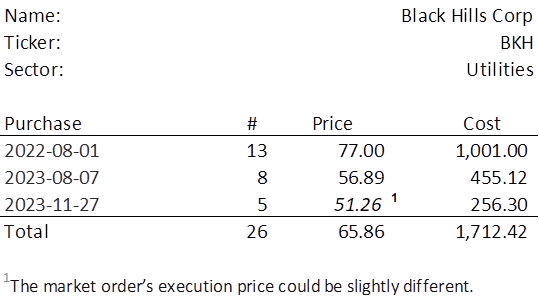

BKH last traded at $51.26. Therefore, in order to invest a minimum of $250 in BKH, I need to purchase 5 shares on Monday. Below, is the purchase history and average cost calculation.

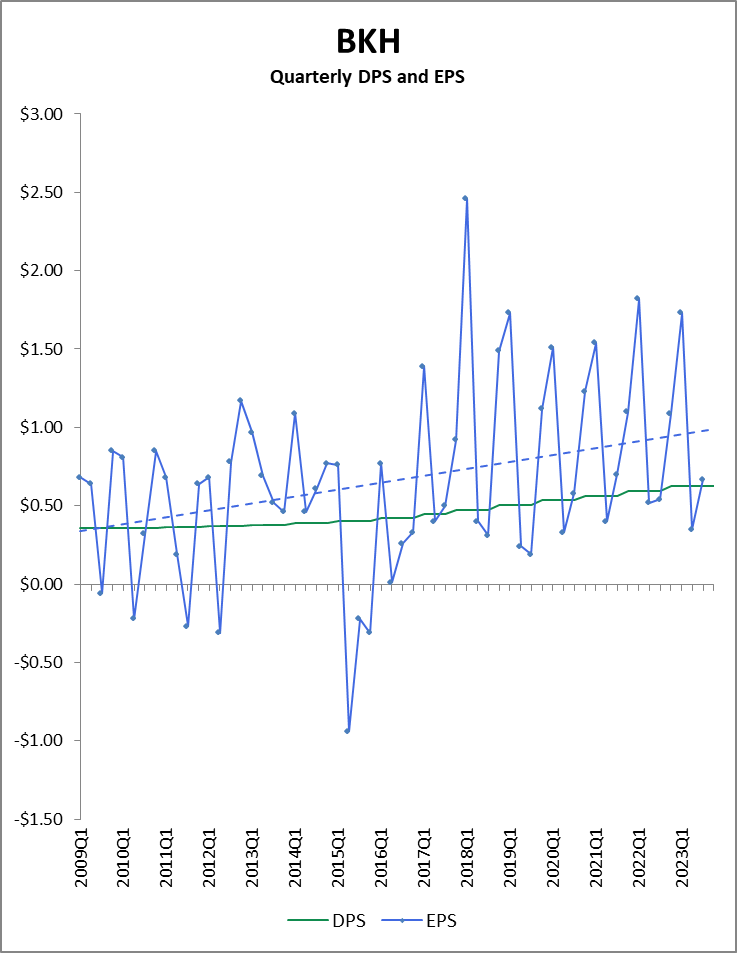

Given the portfolio is about to pick up a few more shares of BKH, I thought it would be illustrative to take a quick look at some charts and graphs. In the first, you’ll find that BKH has quite a bit of seasonality to their earnings per share (EPS), but a nice upward, linear trend (dotted blue line). The dividends per share (DPS) has been climbing as well. That’s to be expected given BKH is a Dividend King.

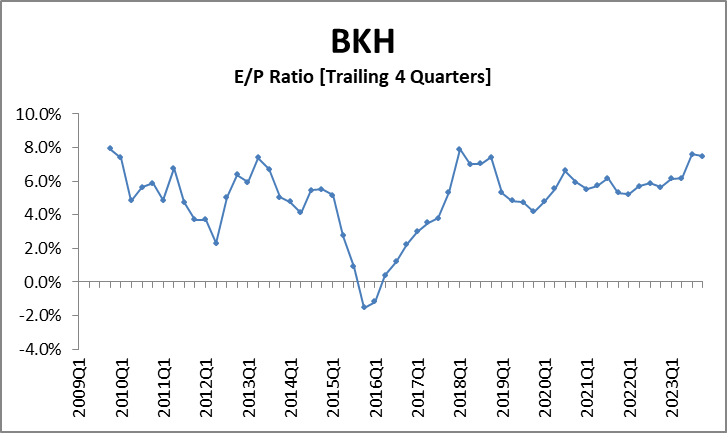

The following graph shows that it is a great time to invest in BKH; the earnings-to-price (E/P) ratio is at the high end of its trading range.

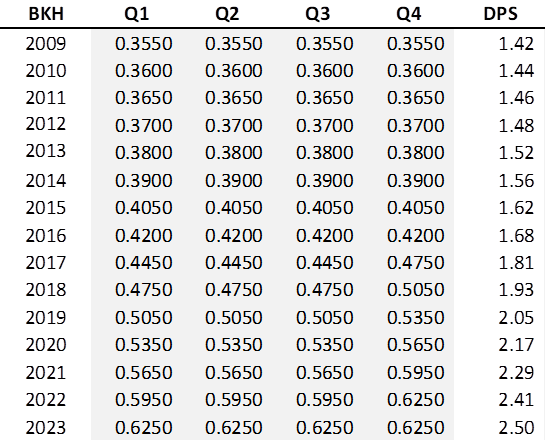

Of some concern is the fifth consecutive quarter of the 62.5 cent dividend. This is the first time in recent history that this has happened.

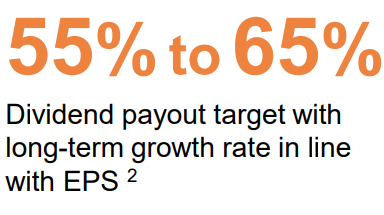

I suspect BKH chose to hold the dividend steady for another quarter because the current payout ratio (trailing four quarters of dividends to earnings) is at 65% (2.50/3.84), the high-end of their target range.

The same mid-November financial presentation indicates that shareholders can expect additional information on the dividend in the near future: “2024 EPS guidance, 2024-2028 capital forecast and dividend update to be provided at Q4 earnings in February 2024”.

Certainly, this is something to keep an eye on. I do not like to be disappointed; I expect a higher dividend in CY2024.