This week’s selection is the only Dividend King representing the Real Estate sector. In fact, it is a Real Estate Investment Trust (REIT). If you have ever thought owning real estate might be a good investment but either a) don’t have the assets to acquire another property, or b) aren’t interested in the management of rentals, REITs are a great way to get in on the action. Congress legislated REITs into existence in 1960. REITs allow investors like you and I to own shares in commercial real estate portfolios – portfolios containing buildings and properties we wouldn’t be allowed to walk into, let alone acquire.

There are private REITs, public non-listed REITs, and public exchange-listed REITs. Among the last category, we have equity REITs, mortgage REITs, and equity/mortgage hybrid REITs. Equity trusts own and manage income-producing real estate. Mortgage trusts borrow money on a low rate, short-term basis and turn around and lend that money to real estate owners on a high(er) rate, long-term basis. They expect to profit from the interest rate spread and thus are highly sensitive to interest rates. Hybrids do a little of both. Why do we care?

Aside from other requirements, a REIT must pay out at least 90% of its taxable income in the form of dividends. That’s right, if they make money, they have to pass on nearly all of it to the shareholders. And Federal Realty Investment Trust has been doing it since the beginning.

Federal Realty Investment Trust [FRT]

Here is the profile from Yahoo! Finance:

Federal Realty is a recognized leader in the ownership, operation and redevelopment of high-quality retail-based properties located primarily in major coastal markets from Washington, D.C. to Boston as well as San Francisco and Los Angeles. Founded in 1962, Federal Realty’s mission is to deliver long-term, sustainable growth through investing in communities where retail demand exceeds supply. Its expertise includes creating urban, mixed-use neighborhoods like Santana Row in San Jose, California, Pike & Rose in North Bethesda, Maryland and Assembly Row in Somerville, Massachusetts. These unique and vibrant environments that combine shopping, dining, living and working provide a destination experience valued by their respective communities. Federal Realty’s 106 properties include approximately 3,100 tenants, in 25 million square feet, and approximately 3,200 residential units. Federal Realty has increased its quarterly dividends to its shareholders for 54 consecutive years, the longest record in the REIT industry.

I added that bold emphasis in the profile. Obviously, FRT is very proud of their dividend increase streak and the difficulty of this achievement for a REIT. I noticed they’re on sale right now; I’m going to buy some!

The Details

Data as of 2022-07-23

| Name | Federal Realty Investment Trust |

| Ticker | FRT |

| Website | Investor Relations |

| Sector | Real Estate |

| Dividend Streak | 54 years |

| Last Price | $102.66 |

| Div Amt (quarterly) | $1.07 |

| Ann Dividend | $4.28 |

| Last Ann Div Inc | 0.9% |

| Dividend Yield | 4.2% |

| Payout Ratio1 (ttm) | 72.7% |

| Beta (5-yr monthly) | 1.15 |

| P/E Ratio1 (ttm) | 17.43 |

| Margin of Safety | 33.5% |

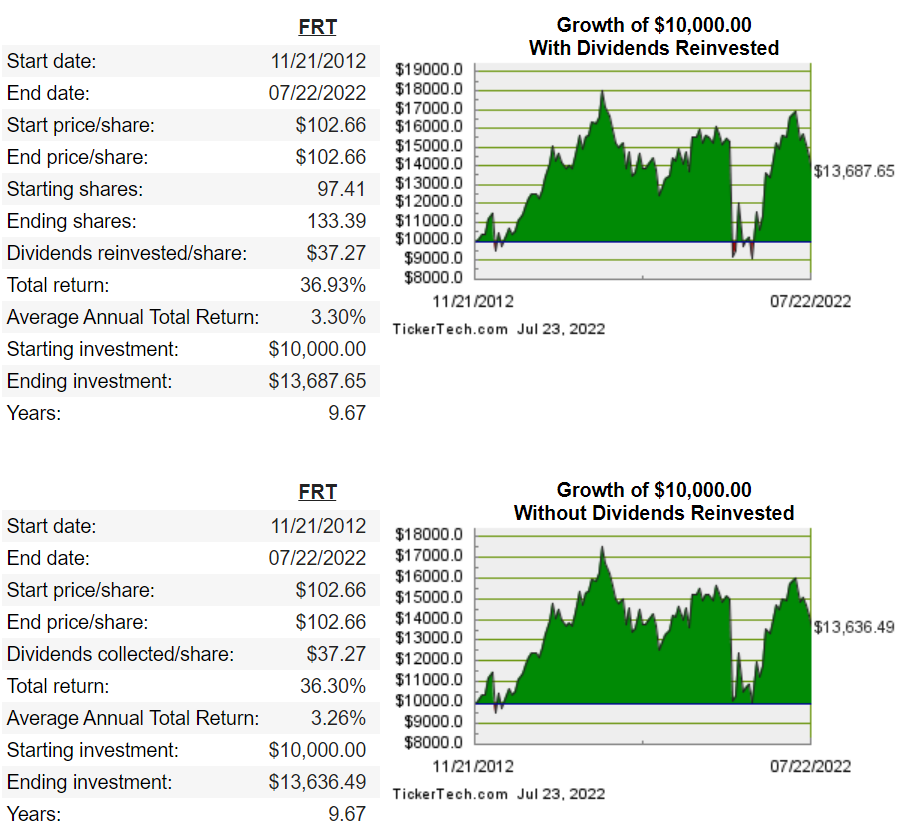

FRT just closed at $102.66. They closed at $102.66 on November 21, 2012. What if someone had purchased $10,000 worth of shares that day and still had them?

Whether or not one chose to reinvest their dividends directly into FRT really hasn’t mattered over this near 10-year stretch. The results haven’t been great. The dividend has been the entire return. In the case of FRT, the lackluster price performance is precisely what creates the opportunity for us right now. FRT’s Funds from Operation (FFO) in 2012 was $4.31 per share. FFO over the last 12 months was $5.89 per share, 37% higher.

I believe FRT is undervalued right now. Their historical P/FFO Ratio over the last decade has been just over 23 and reversion to the mean is likely. I have set up a market order this evening to purchase FRT on Monday.

1I am using funds from operations (FFO) of $5.89 per share over the last twelve months, instead of earnings per share (EPS) as the denominator in the Payout Ratio and the P/E Ratio. For REITs in particular, EPS can be heavily influenced by depreciation and thus, is not useful in these measures.