This week, four of the portfolio holdings ranked in the Top 10: FMCB, MDT, MMM, and PII.

| Ticker | Account Value |

| FMCB | 2,823.00 |

| MDT | 1,270.92 |

| MMM | 2,192.82 |

| PII | 921.80 |

As of this writing, the portfolio no longer has a sector imbalance. However, there is currently an overexposure to the following positions (tickers in bold made the Top Ten this week): TDS, QCOM, FMCB, MO, MMM, NC, TGT, and MDT. None of these tickers are eligible for additional investment at this time. No matter, the lowest amount belongs to PII and it is eligible for an investment of additional funds.

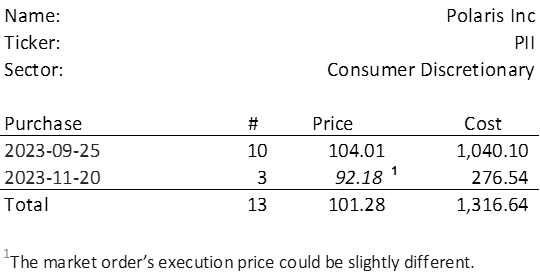

PII last traded at $92.18. Therefore, in order to invest a minimum of $250 in PII, I need to purchase 3 shares on Monday. Below, is the purchase history and average cost calculation.

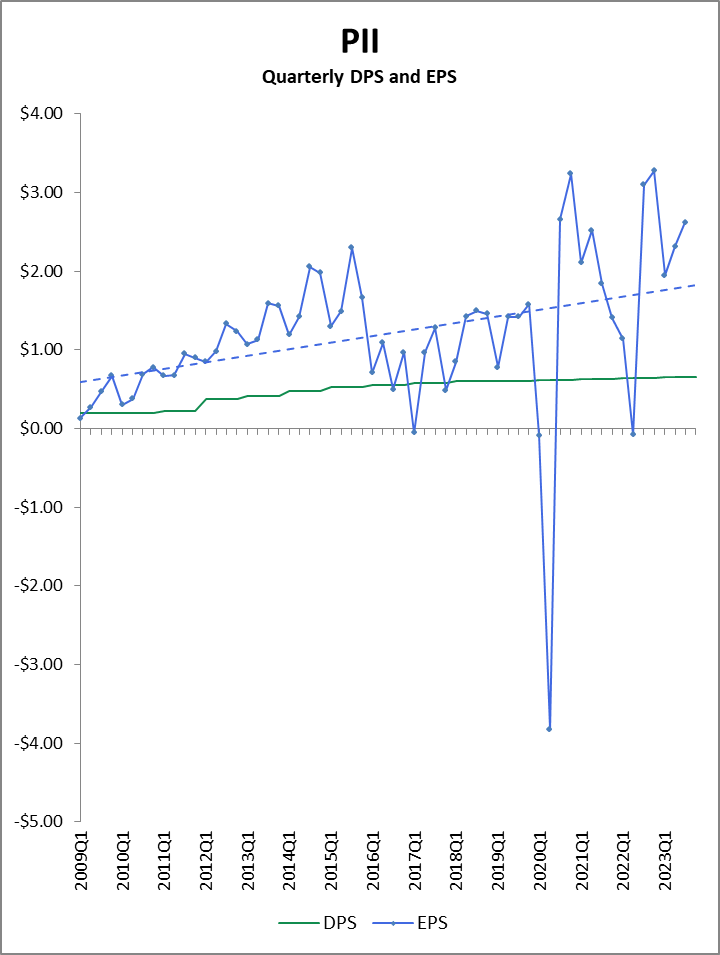

Given the portfolio is about to pick up a few more shares of PII, I thought it would be illustrative to take a quick look at two graphs. In the first, you’ll find that PII has quite a bit of seasonality to their earnings per share (EPS), but a nice upward, linear trend (dotted blue line). The dividends per share (DPS) has been climbing but the growth has been slowing down. And of course, the effect of Coviddery is quite obvious.

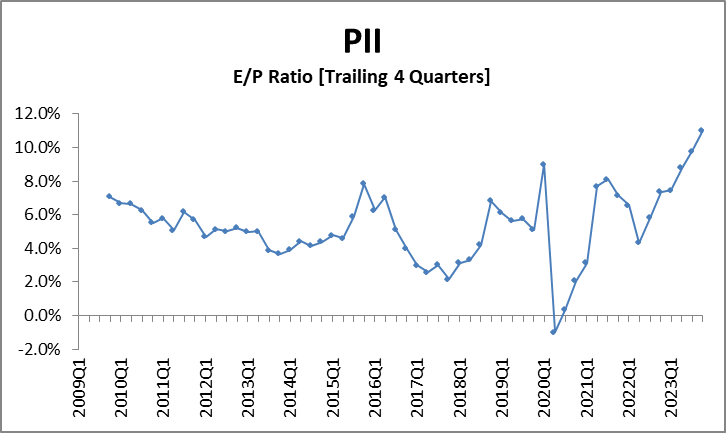

The following graph shows that it is a great time to invest in PII. The market is definitely of the “What can you do for me?” mindset and not at all of a “What have you done for me, lately?” mindset.

The earnings-to-price (E/P) ratio is at its highest level in years. This isn’t just the product of a substantial price decline of 33% since the end of July, but it just so happens that PII just had its third best four-quarter stretch of earnings ever at $10.17 per share.