In 1885, the Statue of Liberty arrives in New York Harbor. That same year sees the formation of the St. John’s Electric Light Company in the province of Canada now known as Newfoundland and Labrador. Some 40 years later, the company is renamed, not Electric Light Orchestra, but Newfoundland Light & Power Co. Limited. In 1987 it becomes the first wholly owned subsidiary of a holding company named Fortis Inc, created specifically to hold Newfoundland Light & Power, but also to expand and diversify. More decades pass and yada, yada, yada…. that holding company announces their 50th year of consecutive dividend increases.

All hail Fortis Inc!

O Canada

The very first thing you see when you visit their home page is the screen shot below.

Fortis Inc is proud of their achievement.

According to Yahoo! Finance:

Fortis Inc. operates as an electric and gas utility company in Canada, the United States, and the Caribbean countries. It generates, transmits, and distributes electricity to approximately 443,000 retail customers in southeastern Arizona; and 102,000 retail customers in Arizona’s Mohave and Santa Cruz counties with an aggregate capacity of 3,328 megawatts (MW), including 68 MW of solar capacity and 250 MW of wind capacity. The company also sells wholesale electricity to other entities in the western United States; owns gas-fired and hydroelectric generating capacity totaling 65 MW; and distributes natural gas to approximately 1,076,000 residential, commercial, and industrial customers in British Columbia, Canada. In addition, it owns and operates the electricity distribution system that serves approximately 584,000 customers in southern and central Alberta; owns 4 hydroelectric generating facilities with a combined capacity of 225 MW; and provides operation, maintenance, and management services to five hydroelectric generating facilities. Further, the company distributes electricity in the island portion of Newfoundland and Labrador with an installed generating capacity of 143 MW; and on Prince Edward Island with a generating capacity of 90 MW. Additionally, it provides integrated electric utility service to approximately 68,000 customers in Ontario; approximately 274,000 customers in Newfoundland and Labrador; approximately 33,000 customers on Grand Cayman, Cayman Islands; and approximately 17,000 customers on certain islands in Turks and Caicos. It also holds long-term contracted generation assets in Belize consisting of 3 hydroelectric generating facilities with a combined capacity of 51 MW; and the Aitken Creek natural gas storage facility. It also owns and operates approximately 90,200 circuit Kilometers (km) of distribution lines; and approximately 51,200 km of natural gas pipelines. Fortis Inc. was founded in 1885 and is headquartered in St. John’s, Canada.

FTS becomes the 9th Dividend King from the Utilities sector and the 2nd Canadian King. Here is the list of all the Kings in the Utilities sector and the industry in which they conduct their business.

| Company | Ticker | Industry |

| American States Water Co | AWR | Water Utilities |

| Black Hills Corp | BKH | Multi-Utilities |

| Canadian Utilities Ltd | CDUAF | Multi-Utilities |

| California Water Service Group | CWT | Water Utilities |

| Fortis Inc | FTS | Electric Utilities |

| Middlesex Water Co | MSEX | Water Utilities |

| National Fuel Gas Co | NFG | Gas Utilities |

| Northwest Natural Holding Co | NWN | Gas Utilities |

| SJW Group | SJW | Water Utilities |

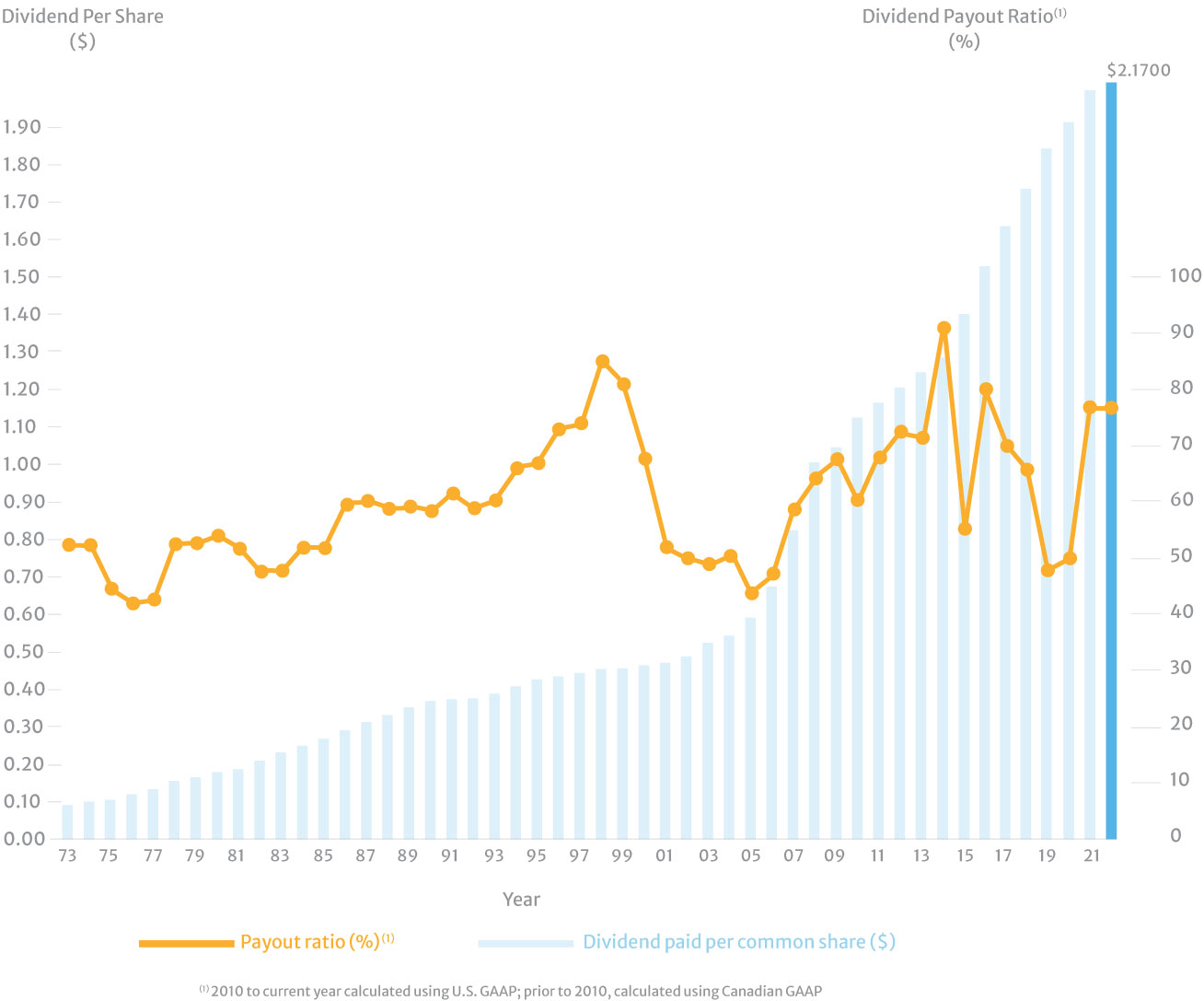

Utilities find their way to the throne more often than most sectors because of the nature of their business. There is always demand for their products and competition is regulatorily limited. Make no mistake though – while it may be easier for a Utility to become a Dividend King, it is by no means easy. FTS is the only Electric Utility in North America to have put together a 50-year streak of increasing their dividend. And that streak is only a little over a third of the time they’ve been in business. They’re just getting started. Take a look at the dividend history chart from their website.

This is a most impressive history. Keep in mind that living in the Unites States means the dividends you’ll receive may not always seem like they’re going up each year due to fluctuations in the exchange rate.

The stock price hasn’t gone anywhere in over 4 years, but the dividend keeps going up in predictable fashion. Furthermore, according to their investor relations page, investors can expect ‘4-6% average annual dividend growth’ to 2028. At some point, I would expect the stock price to begin reflecting reality.