TDS broke $20.00 for the first time in a while on Friday, November 3, 2023. I would like to have a bit more breathing room with this position. As a result, I have chosen to roll up and out. The details are below.

In the same, two-legged, GTC option order:

Buy to Close: (3) February 16, 2024 $20.00 Call Options [Symbol: TDS240216C20]

Sell to Open: (3) May 17, 2024 $22.50 Call Options [Symbol: TDS240517C22.5]

Limit Order Price: Credit of $0.15 per share

I was lucky enough to get a $0.22 credit from my order affecting 300 covered shares. After commissions, this resulted in a $62.92 credit and nearly equals the last quarterly dividend of $63.83 on all 345 shares. That’s a nice roll credit for a 3-month extension in the expiry date and the possibility of receiving an additional $750 in capital gains should TDS climb further on any good news. And they could use some.

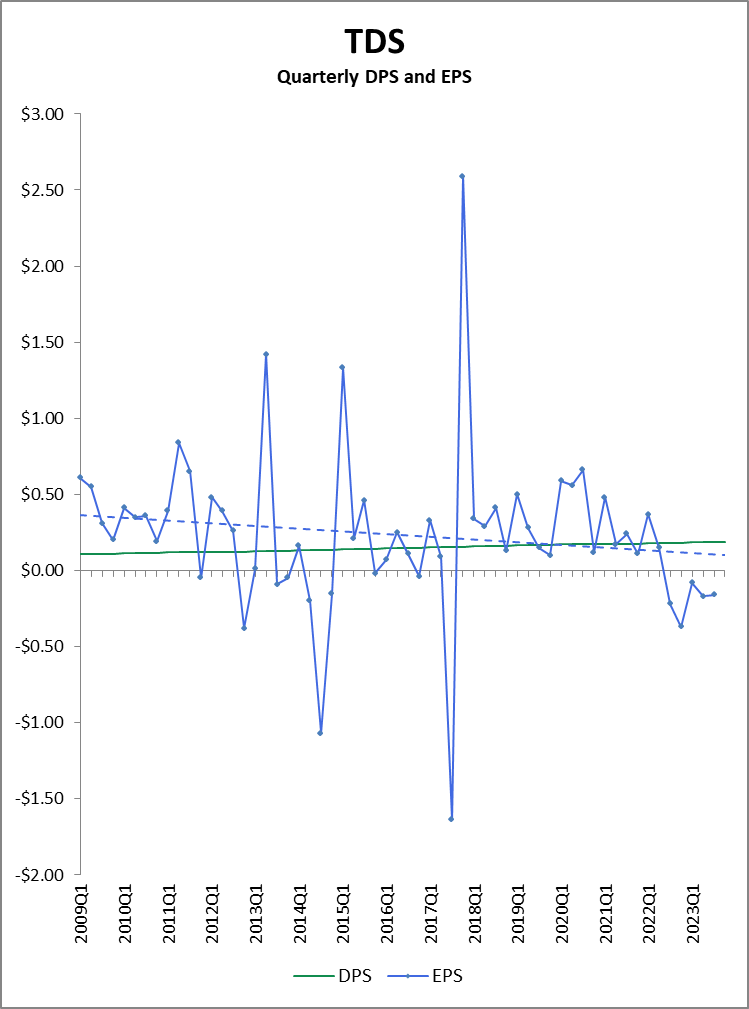

Visualizing Volatility

The Wireless Telecommunications Services industry within the broader Communications Services sector is a highly competitive space with some giants. Think AT&T [T], Verizon {VZ], and T-Mobile [TMUS]. TMUS is the smallest of these three and could write a check for TDS and not even know they spent the money. Being a small player in this industry makes for rather volatile earnings per share [EPS].

The graph speaks for itself, but I will add some comments. First, the long-term EPS trend would have been difficult to visualize if not displayed. It is the dotted line and is treading downward, almost a mirror image of the upward trending dividends per share [DPS] line. Second, this is the only 5-quarter streak of negative earnings in the time period shown.

Now, you might think the trend line has been influenced quite a bit by this recent stretch of negative earnings, and it has been. However, even if the last five quarters were to be removed, the trend line would still have a small negative slope.

Dealing with Volatility

As a dividend investor, I am concerned for the safety of the dividend. TDS could become a Dividend King in 2024, but there is a possibility that they don’t make it. They are in a precarious position and the price level and volatility reflect this. This is the reason I am selling covered calls and trying to allow room for further capital appreciation. They could be acquired for more than the current stock price, or TDS could sell their stake in US Cellular [USM], which some analysts believe would be worth more to a larger player than is currently reflected in the prices of either TDS or USM.

Also possible, is a turnaround in earnings; it certainly has happened before.

If nothing happens, at least I will have collected substantially more income than that of just collecting the dividend alone. More income means working down my cost basis so that even if the stock were to drop to $9.00, I would still come out ahead.