The Portfolio for the Ages came to life with the acquisition of FMCB, a little-known Dividend King, on July 18, 2022. There are now 15 positions covering all 11 sectors and one can see the performance and portfolio characteristics at the relevant menu links1.

Save the stock price performance of TDS, the portfolio’s performance has been a disappointment. I have to emphasize that it is TDS’s price performance that has been phenomenal, as its business performance has been the worst of any of the holdings. And if that doesn’t tell you something about investing in the short term, I’m not sure what does. I am deliberately passing on the opportunity to compare the Royal Dividends portfolio performance to that of SPX or NOBL at this time, in order to stress the importance of dividend accumulation.

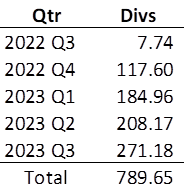

We can essentially ignore the first quarter as things were still ramping up at the time. This growth is the result of investing regularly into companies that pay dividends. Not just any companies, but companies that have been paying dividends for several decades and increasing those dividends every year over that same time period.

To date, I have invested $27,432.29 and now the account is up to $28,517.65. How did this come to be? Well, I can tell you that this unrealized gain of $1,085.35 is comprised of $(83.92) in unrealized loss in price, $379.63 in (mostly) realized option premium born out of my desire to boost the dividend safety of TDS with additional income, and the $789.65 of dividends received. That’s right. After 14 months, the stock prices have basically gone nowhere in the aggregate and the 4% return is essentially 3% dividends and 1% option premium.

I expect the economy to continue to slow and corporate earnings to do the same. Things will likely continue to get worse, perhaps through 2024 and into 2025, before the market and the economy grow in the way we’ve come to expect. One thing I do not expect is for these companies to stop annually increasing their dividends.

1I certainly could put the links directly into the text here, but then it would trigger odd messages on the web services I hate to use. Obviously, I need the help of professionals and the money to pay for their services. So, until the market gets its head out of its ace, or a mysterious benefactor, so blown away with the site’s content that he or she decides to provide web services or funds commensurate with the content, the site will continue to look and function like it was built by an idiot savant.