What exactly is Dividend Yield? According to Investopedia, the dividend yield, expressed as a percentage, is a financial ratio (dividend/price) that shows how much a company pays out in dividends each year relative to its stock price. That’s as good a definition as any, but it leaves a few details out. It makes no mention of why we calculate it in the first place. Yield helps us put every stock on an even playing field, by relating their dividend to the magnitude of their price. A company with a $10 dividend trading at $100 per share will have the same yield as a company with a $1 dividend trading at $10. The dividend yield is 10% in each case. But the devil is always in the details. Most sites use either the last day’s closing price or even the real-time, current stock price as the denominator, and that makes perfect sense. However, it’s typically the choice for the numerator that creates the greater difference in published yields for a given stock. Some will use the trailing twelve month’s paid dividend and others will annualize the last paid dividend.

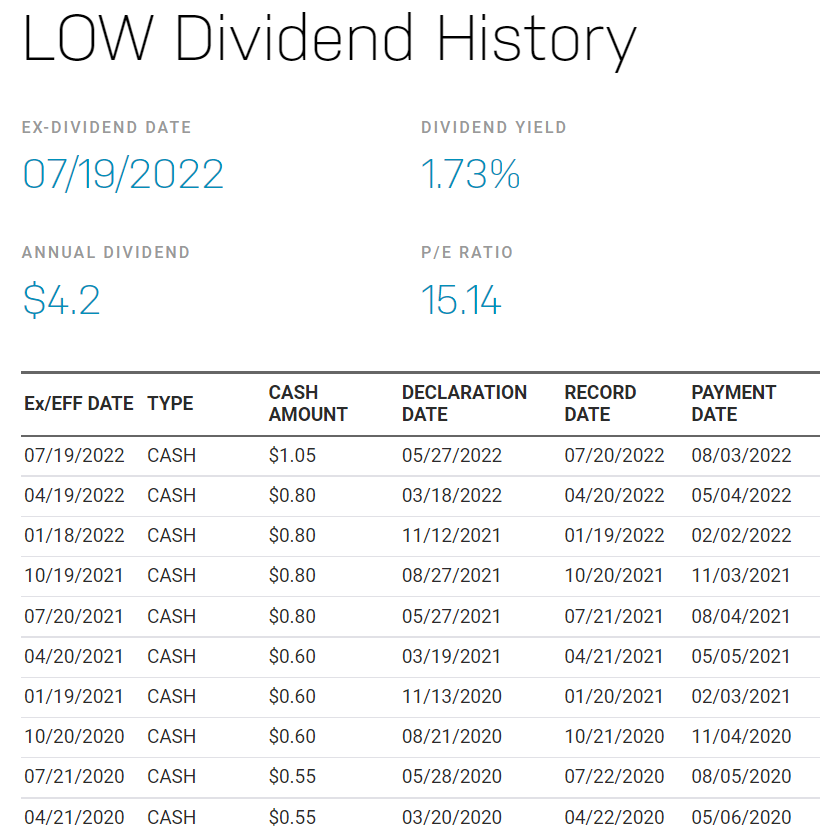

My formula for Dividend Yield annualizes the most recent declared, regular dividend and divides it by the last closing price. This is the best calculation because it is both prospective and conservative. It answers the question of what a purchaser of the stock today can conservatively expect to receive over the next year. Let’s look at the same example for Lowe’s Companies, Inc [LOW] using one of my favorite locales for accurate dividend information, Nasdaq’s own website.

Fun with Numbers

Lowe’s declared their next regular quarterly dividend on May 27th. We assume that they will stay at this level for the three quarters that follow. Their closing price on July 18, 2022 (the day before this screenshot) was $185.79:

Dividend Yield = (4 x 1.05)/185.79 = .0226 or 2.26%

So clearly, the Nasdaq website is annualizing the most recent declaration of $1.05 by stating that the annual dividend is $4.20. However, they are not using that number in their dividend yield calculation. For that, it appears they are using $0.80 x 4 = $3.20 and dividing it by the closing price of $185.00 from two trading days ago, July 15th. So, there is a small two-day lag in the denominator, and the numerator will reflect the proper annualized dividend of $4.20 at some point in the near future. But make no mistake, the 2.26% is the more accurate yield and it properly reflects the rather large increase they have just made to their dividend. This is a good example for illustrating why the details matter.

Other Considerations

In the event I encounter a company that tends to pay and raise their dividend on a quarterly basis, I will conservatively assume that their latest declared dividend will remain fixed for the whole of the year.

We may as well use this exhibit to demonstrate another calculation that is useful, Last Annual Dividend Increase. Some would say that the last dividend increase for LOW is (1.05/.8) – 1 = .3125 or 31.25%. That’s the last quarterly dividend increase for sure, but until $1.05 has been paid for four quarters, it really isn’t accurate to say that the annual increase is 31.25%. I prefer to do a rolling 12-month calculation on a quarterly basis to gauge the annual pace at which a company is raising its dividend.

Last Annual Dividend Inc = (1.05 + 0.80 + 0.80 + 0.80) / (0.80 + 0.60 + 0.60 + 0.60) – 1 = .3269 or 32.69%

If you’re lucky enough to own shares of a company that pays a special dividend, even regularly, enjoy it, but do not expect it to be included in any forward-looking dividend yield. Just as it isn’t exactly conservative to anticipate increases to the quarterly dividend, it wouldn’t be conservative to expect special dividends.