This is an addendum to this weekend’s post. Originally, FMCB made the Top Ten and it was the portfolio holding to which I was going to add. However, FMCB is very thinly traded and my limit order to purchase 1 share at $967 did not execute today. It closed at $975 and at that level it would not have made the Top Ten in the first place. I have chosen to keep my limit order in place in the hopes that it will execute; there is a good chance the market will tank after Fed Chair Jerome Powell hikes the rate once again on Wednesday. Regardless of whether the FMCB trade executes, I am moving forward with acquiring more shares of QCOM, the result of assessing the situation had FMCB never made the Top Ten.

This week, three of the portfolio holdings ranked in the Top 10: MMM, QCOM, and TDS.

| Ticker | Account Value |

| MMM | 2,434.55 |

| QCOM | 2,316.80 |

| TDS | 2,397.60 |

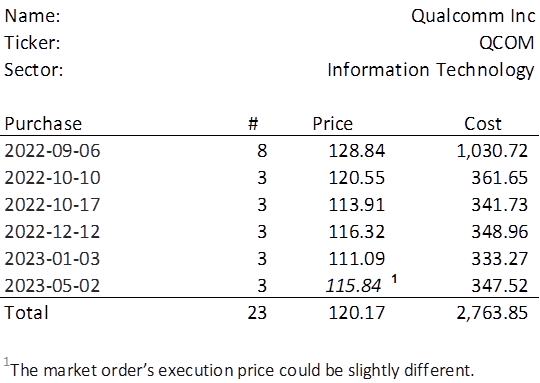

The lowest amount belongs to QCOM. In order to invest a minimum of $250.00 in QCOM, I need to purchase 3 shares tomorrow. Below, is the purchase history and average cost calculation.

Should my limit order to acquire 1 share of FMCB for $967 execute, the amount invested this week will be north of $1,250 and therefore, no installments will be made over the following four weeks. This will maintain the average of $250+ invested per week.