On February 20th, in the interest of raising some covered call premium as a hedge against the chance that TDS would not be able to continue their amazing 49-year streak of dividend increases, I set up a limit order on a GTC basis. There are 215 shares of TDS in the portfolio and thus the order was for 2 contracts, representing 100 shares each:

Sell to Open: 2 August 18, 2023 $17.50 Call Options [Symbol: TDS230818C17.5]

Limit Order Price: Credit of $0.56 per share

I knew TDS would have to move up a bit from where it was at $13.70 in order for the trade to trigger at $0.56. I mentioned later in the post that I might be willing to accept $0.38 as that would still be twice the quarterly dividend. Sadly, the market gapped down before market open on Tuesday the 21st and even $0.38 wouldn’t trigger.

In fact, over the last 7 trading days, TDS has dropped nearly 12% to $12.11. Rather than wait to see whether or not it can bounce back to $14 in the coming weeks, I decided to take action.

“I never buy at the bottom and I always sell too soon.”

Baron Nathan Rothschild

In my investing experience, taking action equates to settling for less. Paying more for a stock, accepting less when selling, getting less option premium. Why is this? Well, it isn’t for lack of patience or discipline. The reality is that it is next to impossible to perfectly time the market. I know perfectly well that the market can go on a rally for the next week and TDS right along with it. It could find itself over $14 next Wednesday.

In fact, there’s a primal part of me that is absolutely convinced TDS would not be able to embark on such a rally, unless and until, I forfeit my rights to the profitable promise portended by such an upward move, by selling a covered call and capping my gains at some strike price that, in short order, will inevitably and undoubtedly prove to be insufficiently high.

However, there’s also common sense. And common sense says, TDS is going to tread water, bobbing up and down with the whims of the general market, until the next earnings report. It is more likely, now that it is trading near $12, that a $17.50 call is just not going to sell for a worthwhile premium any time soon.

Staying Flexible

So, when I saw TDS trading a hair under $12, down for the sixth day out of the last seven, I made three adjustments.

Sell to Open: 2 May 19, 2023 $15.00 Call Options [Symbol: TDS230519C15]

Limit Order Price: Credit of $0.20 per share

I cut the length of the option in half, from two quarters out, to just one (actually less, only 79 days). I dropped the strike price to $15 and decided that I wanted at least one dividend’s worth of premium for this one quarter-ish time period.

And it processed after about 30 minutes. After commissions, the total premium received was $38.98. That’s not bad for an option that, according to ThinkOrSwim, has an 89% chance of expiring worthless.

Outlook

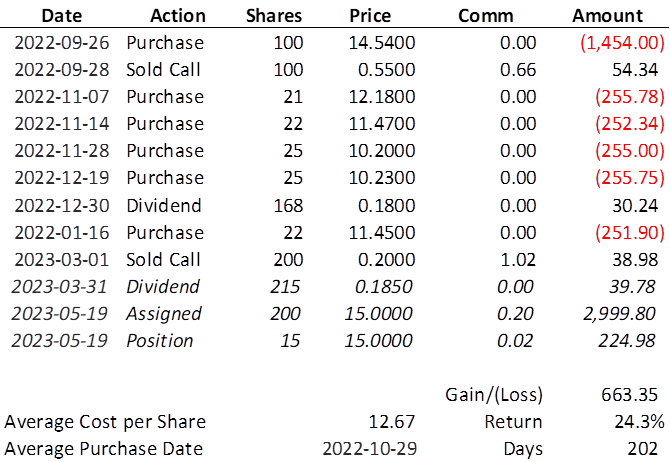

In the event TDS climbs 25% in the next 79 days, here is how my investment will have played out.

Again, there’s essentially a 90% chance that the scenario above does not play out. If it does, I won’t be upset at the 24.3% return, 48% annualized. If the call expires worthless, I will have received $70.02 in dividends and $93.32 in covered call premium. That’s an income of $163.34 on $2,724.77 invested, or 6% over the 202 days that will have passed from the average purchase date. That’s a healthy 11% annual income while I wait for the stock price to appreciate.

Oh, I placed my order at what turned out to be the absolute low point of the day. TDS monotonically climbed the rest of the day, closing at $12.11. I expected no less.