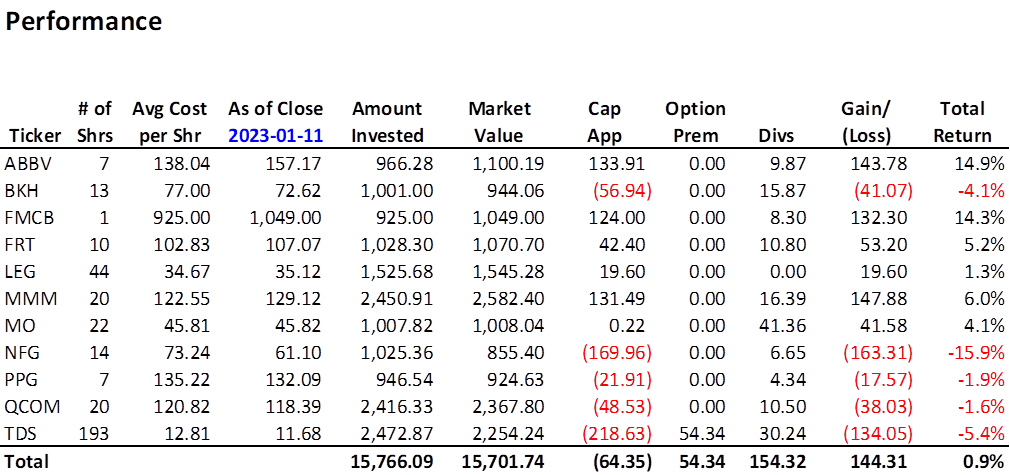

Ordinarily, I update the Performance page once a week, the evening after the latest investment. Last night was the first time I could recall seeing a positive return since September 26, 2022, when the portfolio reached its initial maturity level of 11 positions, one stock from each sector. This is obviously good news. However, investors do like a yard stick, a way of measuring whether or not this is good performance or not. Unfortunately, there is no easy way to compare the performance of this portfolio to that of an index for multiple reasons which will be explained.

Yet, the thirst for comparison remains and so I search for a suitable benchmark.

The First Positive Sign

As of market close January 11, 2023, it is my belief that the portfolio’s Gain/(Loss) of $144.31 is the first time the portfolio has been in the black. As 16-time world champion Ric Flair would say – “Whoo!”

A few things to point out:

- 6 of the 11 holdings have positive returns

- only one company, LEG, has not yet paid a dividend, but it is expected on Friday

- without dividends (and a little option premium) the portfolio would be showing a loss

- the lowest return, including dividends, belongs to NFG, largely due to a significant drop in oil prices

- the worst stock performance belongs to TDS which has fallen 19.7% from the original entry price of $14.54

TDS would have shown the worst total return except for the fact that a) I gradually acquired 93 more shares after the original entry, on four occasions, effectively lowering my average cost from $14.54 to $12.81, and b) I sold a covered call on the first 100 shares for a premium equal to three quarters’ worth of dividends. So instead of being down 18.4% (after the one $18 dividend that would have paid on those first 100 shares), it is only down 5.4%.

Difficult Comparisons

It is difficult to compare the portfolio performance to a benchmark. Even if we could find a suitable index in terms of the stock holdings, there are several features that create comparison challenges. The 11 stocks that have been chosen were not selected at one time, but over a two-month time period. Additional funds are invested into the portfolio each week. Whereas most indices are weighted by market capitalization or equally weighted, Royal Dividends prefers to overweight stocks with the highest expected future returns. One covered call has been sold as a hedge against what might be perceived as an unsafe dividend in TDS. There’s also the simple matter that dividends are to be reinvested, but not necessarily into the stocks that paid them. Each of these features precludes a sound mathematical comparison to an index. Of course, there is yet another problem, one of fit.

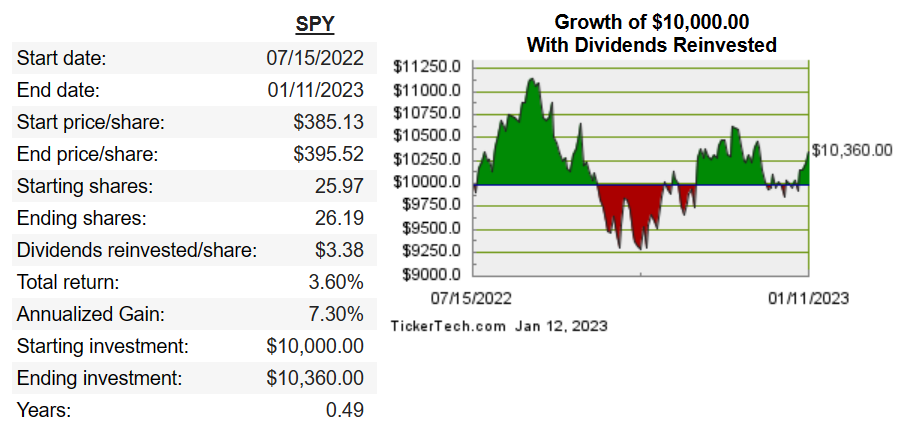

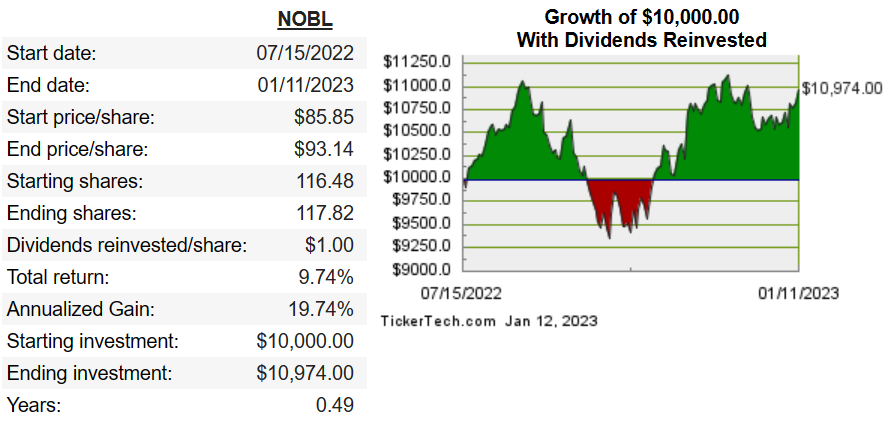

The S&P 500 Index [SPX] is a poor fit. The top 6 holdings, Apple [AAPL], Microsoft [MSFT], Amazon [AMZN], Berkshire Hathaway [BRK.B], Alphabet [GOOGL, GOOG] and United Healthcare [UNH] make up 20% of the index and aren’t even in the Royal Dividends Empire of stocks, let alone the Portfolio for the Ages. There is no index or ETF dedicated to the Dividend Kings as of the time of this writing. Such an instrument would be a good benchmark from a fit perspective. We do have the next best thing though – the S&P 500 Dividend Aristocrats Index. It is an equally weighted index of the S&P 500 companies that have increased dividends every year for the last 25 consecutive years. Unfortunately, the ticker for the index is not universal and is unavailable on some brokerage sites. There is, however, an ETF that tracks this index, the ProShares S&P 500 Dividend Aristocrats ETF [NOBL]. This is likely the best fit out there.

Measuring Up

What starting date should we use? The first portfolio purchase, FMCB, was made at market open on July 18, 2022. The previous market close was July 15th. TDS was the last addition, first purchased on September 26, 2022. The previous market close would have been September 23rd. The portfolio could have been considered mature at that point, but at least $250 has been added every week thereafter into a subset of four stocks with the most potential upside.

I’ll cut to the chase. I am choosing July 15, 2022, because it makes the most sense as a launch date and since it is a more favorable comparison. Hey, everybody does it.

The last detail within our control is to select the appropriate return metrics. In this case, it is total return with dividends reinvested. Even though it is ill-fitting, here is the S&P 500 Index total return, using SPDR S&P 500 ETF [SPY].

Here is the total return of NOBL:

SPY has returned 3.6% and NOBL, 9.7%. And so, the Royal Dividends portfolio with its 0.9% return can be said to have underperformed. But let’s have some composure for crying out loud and keep the following in mind:

- SPY is a poor fit

- NOBL is a better fit, but by no means a great fit

- the portfolio is not even 6 months old

- new money is added weekly

- no attempt is made to equally weight or have weights based on market capitalization

- there is tremendous dividend safety

- there is less observable volatility

- this portfolio should underperform the S&P 500 in the best of times

- this portfolio should overperform the S&P 500 in the worst of times

- according to Benjamin Graham, a realistic long-term performance expectation in equities is 7%

My personal thoughts on the matter? I would like to average 8% per annum over the long haul. If that falls short of the S&P 500 Index, so be it. Likewise, I am not trying to beat the S&P 500 Dividend Aristocrats Index. If I were, I would invest in NOBL and return bottles and cans to put me over the top.

I had to wait nearly 6 months to break into the positive, but I am happy so far. I’ve continued to add to MMM, QCOM, TDS, and LEG and when the market realizes that there is unlocked value in these stocks, they should outperform and my portfolio with it.