Dividend King of the Week [SCL][3]

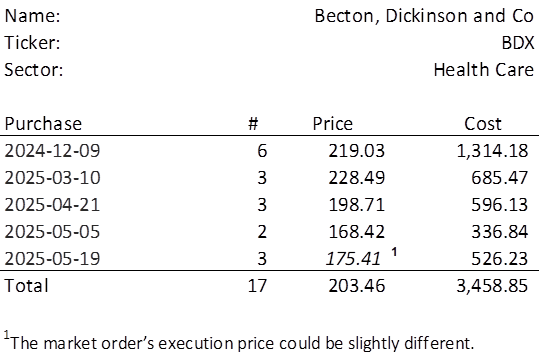

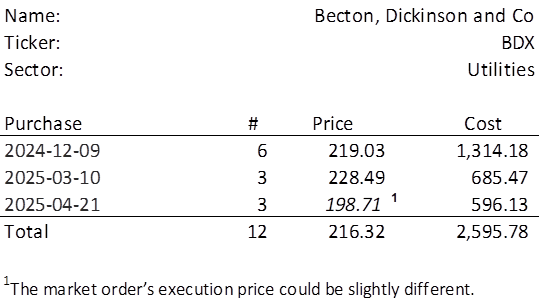

This week, seven of the portfolio holdings ranked in the Top 10: BDX, FMCB, HTO, PPG, QCOM, and SCL.

| Ticker | Account Value |

| BDX | 2,948.65 |

| FMCB | 3,968.04 |

| HTO | 3,231.90 |

| PPG | 3,152.80 |

| QCOM | 3,432.52 |

| SCL | 1,259.25 |

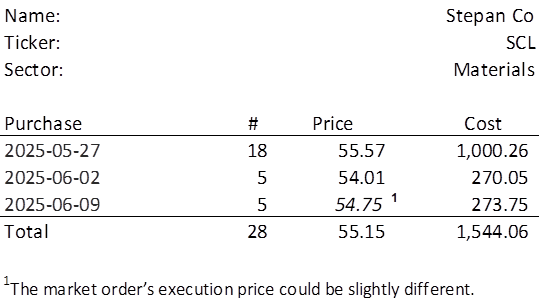

The lowest amount belongs to SCL which last traded at $54.75. Therefore, I will acquire 5 shares of SCL on Monday. See the 2025-05-25 post for a high-level look at their recent performance in the context of the last 16 years. Below, is the purchase history and average cost calculation.